Introduction

The Asian hedge fund industry has witnessed some remarkable trends over the last 11 years in relation to asset growth, performance, development of the service provider space and availability of new products and strategies. At the start of 2000, there were less than 150 hedge fund managers who were investing in the region, including those based outside Asia, with a total AuM of less than US$20 billion. Since 2000, the sector started attracting greater attention from investors and managers alike and in the five years between 2002 and 2007, Asian hedge funds witnessed explosive growth, with the number of funds increasing from 377 at end-2002 to 1,235 by end-2007 and the assets under management increasing by more than 600% to hit US$176 billion. After peaking in December 2007, the size of the region’s hedge fund industry was hit by the combined effect of withdrawals and performance-based losses due to the credit crunch and global financial crisis. Assets under management fell to US$104.8 billion in April 2009. Since then, however, the sector has undergone a remarkable turnaround and managers have attracted significant amounts of capital as well as posting record performances.

Figure 1 shows the growth of the Asian hedge fund industry since 1999.

Figure 1a: Growth of the Asian hedge fund industry

After enjoying a strong recovery in 2009, Asian hedge funds witnessed a few rough months in early 2010 as markets were unpredictable and investors remained on edge due to fears of the European debt contagion spreading to Asia. However, as managers continued to deliver healthy returns and market sentiment improved, investors resumed healthy allocation activity. Over the last 10 months, Asian hedge funds have gained US$7.3 billion through positive net flows while the Eurekahedge Asian Hedge Fund Index delivered a 8.66% return in 2010 – the total assets under management currently stand at US$129.6 billion.

|

Figure 1b: AuM growth in recent months

|

Industry Make-Up and Growth Trends

Asset Flows

Asian hedge funds started the year 2010 with expectations of strong inflows based on their excellent 2009 returns and the healthy allocation activity seen at the end of 2009. However, after an initial period of profit-taking and portfolio rebalancing, which is normal at the start of the year, most investors withheld their allocations until the second quarter of the year. Concerns over the European debt contagion spreading to emerging markets and Asia had a negative effect on market sentiment while fears of a double-dip recession were reignited. In this environment, managers found it hard to raise capital for their funds, while investors remained cautious about the volatile markets and, on the whole, choosing to hold their allocations.

However, as investor sentiment improved from May 2010, Asian hedge funds started to attract some capital and in the last eight months of the year, the sector gained US$5.9 billion through net positive asset flows. In addition to the positive asset flows, managers also delivered performance-based gains to the tune of US$7.2 billion, bringing the total size of the industry to US$128.6 billion by the end of December 2010. Although these asset flows to Asian hedge funds look healthy enough, they do not match up in comparison to allocations at the global level and to the capital invested in the sector in previous years. The primary reasons for this are:

a) Profile of the investors – most of the money allocated to Asian hedge funds previously came from the ‘less institutional’ investor, ie high-net-worth individuals, family offices and funds of hedge funds. Investors of this category have mostly refrained from investing in 2010, while funds of hedge funds themselves have not received substantial allocation since the financial crisis. Most of the capital that flowed into the hedge fund industry in 2010 has been from large institutional investors such as pension funds, sovereign wealth funds and endowments.

b) Most of the assets that were invested in Asian hedge funds in the pre-financial crisis years came from European investors. These investors have most chosen to allocate to UCITS III hedge funds which are perceived to be safer due to their regulated nature.[1]

c) Large institutional investors, which have been the primary source of asset flows in 2010, have mostly invested in large well-known global funds in 2010. A reason for this may be the limit on the minimum fund size before investing; in fact, out of all Asian hedge funds that received at least US$100 million in allocations in 2010, 80% had a fund size of more than US$100 million.

The last point raises an interesting question about how much of assets in Asia are managed by large hedge funds. Table 1 shows that as at end-December 2010, the largest 20% of funds manage about 78% of Asian hedge fund assets, and this figure had reached nearly 80% in 2009. The data shows that the proportion of assets managed by large hedge funds increased over the last five years and the biggest jump of nearly 2% happened in 2008 when a significant number of smaller funds were forced to close due to losses and heavy redemptions. Larger funds, on the other hand, were able to better handle the crisis, given their larger asset base. The decline in large hedge funds’ share of Asian assets in 2010 was mainly due to the closure of a few large funds at the year-end.

Table 1: Proportion of assets in large Asian hedge funds

Percentage of Asian hedge fund assets

in the largest 20% of the funds

| |

Year

|

% of Assets

|

2005

|

72.8

|

2006

|

74.0

|

2007

|

76.1

|

2008

|

78.9

|

2009

|

79.7

|

2010

|

77.8

|

Source: Eurekahedge

The first two months of 2011 have seen a continuation of the allocation trend from 2010, with managers attracting a total of US$1.6 billion. Table 2 shows asset flows and performance-based growth in Asian hedge funds since the end of 2008.

Table 2: Asset flows across Asian hedge funds

Month

|

Net growth (performance)

|

Net flows

|

Assets at end

|

2008

|

(26.0)

|

(23.6)

|

126.4

|

Jan-09

|

0.1

|

(9.1)

|

117.4

|

Feb-09

|

(0.2)

|

(4.7)

|

112.5

|

Mar-09

|

0.6

|

(4.6)

|

108.5

|

Apr-09

|

1.3

|

(5.1)

|

104.8

|

May-09

|

3.6

|

(2.6)

|

105.8

|

Jun-09

|

0.4

|

(0.2)

|

106.0

|

Jul-09

|

1.6

|

0.5

|

108.1

|

Aug-09

|

(0.2)

|

1.7

|

109.6

|

Sep-09

|

1.0

|

1.2

|

111.9

|

Oct-09

|

(0.0)

|

2.8

|

114.6

|

Nov-09

|

0.9

|

1.0

|

116.5

|

Dec-09

|

0.9

|

(0.1)

|

117.3

|

2009

|

10.1

|

(19.1)

|

117.3

|

Jan-10

|

(1.2)

|

(0.6)

|

115.6

|

Feb-10

|

(0.2)

|

(0.7)

|

114.7

|

Mar-10

|

2.2

|

(0.1)

|

116.8

|

Apr-10

|

0.9

|

(0.4)

|

117.3

|

May-10

|

(2.4)

|

0.7

|

115.5

|

Jun-10

|

(0.3)

|

0.4

|

115.6

|

Jul-10

|

1.1

|

0.5

|

117.1

|

Aug-10

|

0.4

|

0.4

|

117.9

|

Sep-10

|

2.8

|

0.5

|

121.1

|

Oct-10

|

1.8

|

1.9

|

124.8

|

Nov-10

|

0.2

|

0.7

|

125.7

|

Dec-10

|

2.0

|

0.8

|

128.6

|

2010

|

7.2

|

4.0

|

128.6

|

Jan-11

|

(0.5)

|

0.3

|

128.3

|

Feb-11

|

(0.2)

|

1.3

|

129.6

|

Note: All figures are in US$ billion.

Source: Eurekahedge

Although capital allocation to Asian hedge funds has not been as strong as that in other regions or allocations seen in previous years, the sector has witnessed much stronger asset flows in relation to Asian funds of hedge funds which, of course, suggests that the majority of the funds have come from other investors outside of the funds of hedge funds. Figure 2 shows the relative growth of Asian hedge funds versus Asian funds of hedge funds since the start of 2008. While the trend of redemptions from the industry ended by 2Q2009 and hedge funds started to attract capital again, funds of hedge funds have not witnessed any significant allocations. In fact, since 2009, a significant number of funds of hedge fund investors have started allocating directly to hedge funds and we attribute this to the better downturn protection provided by a portfolio of single-manager funds through the financial crisis and their continued significant outperformance over the last three years.

In the three years since the start of 2008, the average Asian hedge fund has gained 14.04% while Asian funds of hedge funds are down 5.16% by the same metric. These returns somewhat counter the main argument in support of investing in funds of hedge funds that while they may not capture all of the upside that a bucket of hedge funds might, they would offer more downside protection during bad years. That was not the case in 2008. Not only did the multi-managers underperform hedge funds in 2008, but they have also been unable to capture the excellent gains delivered by single-fund managers subsequently. The inability of funds of hedge funds to deliver the promised downside protection in 2008 made it that much harder for them to justify the extra set of fees to investors.

Figure 2: Relative growth of Asian hedge funds and funds of hedge funds

Figure 3 shows the monthly net flows displaced by two months plotted against the Eurekahedge Hedge Fund Index which suggest that investors have subscribed two to three months after periods of positive performance and redeemed two months after periods of negative performance at corresponding magnitudes to the underlying performance. Whether this truly suggests that investors are ‘trend-following’ or a simple statistical manipulation is open to some debate.

Figure 3: Displaced 3-month average net flows vs the Eurekahedge Asian Hedge Fund Index

Fund Population

Launch activity in 2010 trended towards further growth in the Asian hedge fund population as the number of launches exceeded the attrition rate. Although the growth rate does not match that seen in the pre-financial crisis years, the data shows that it is trending towards greater growth. Nearly 150 Asian hedge funds were launched in 2010, bringing the total size of the industry to 1,247 funds. The strong launch activity seen so far in 2010 is a result of growing interest in Asia due to greater growth potential in the regional economies as well as developments in the regional hedge fund service provider industry, making it easier for managers to set up their funds in the region. Other factors include increasing availability of complex financial products in the Asian markets, lower set-up costs as compared with the West, desire for large hedge fund investing institutions to diversify into Asia and efforts from Asian governments to attract global managers.

Figure 4: Launches and closures across Asian hedge funds

High-Water Mark

Table 3 gives the percentage of global and Asian hedge funds above their high-water marks by total sector as well as by individual strategies. Since the high-water mark differs from investor to investor, depending on the net asset value level at the time of capital allocation, we take the NAV of funds at December 2008 as the starting point for this analysis to determine whether they are above their high-water marks. This is because hedge funds witnessed significant outflows at that time, and since then, they have raised new capital.

The data shows that while 58% of global managers are above their high-water marks, the number of Asian managers that would have made performance fees is 55%. Although Asian hedge funds delivered excellent returns in 2009, they suffered greater losses in 2008 and additionally, their performance in 2011 did not match that of global hedge funds. When comparing managers of different strategies, we find that a greater percentage of Asian fixed income and relative value hedge funds are above their high-water marks as opposed to global managers operating with the same strategic mandates – and this is primarily attributed to the better returns posted by the Asian managers in 2009 and 2010 vis-a-vis their global counterparts.

Table 3: Global and Asian hedge funds above December 2008 net asset value

Funds Above HWM (%)

|

All

|

Arbitrage

|

Distressed debt

|

Event driven

|

Fixed

income

|

Long /Short

equity

|

CTA

|

Macro

|

Multi-

strategy

|

Relative value

|

Global hedge funds (inc Asia)

|

58

|

67

|

66

|

61

|

63

|

61

|

46

|

57

|

60

|

56

|

Asian hedge funds

|

55

|

50

|

65

|

57

|

77

|

55

|

45

|

43

|

53

|

67

|

Source: Eurekahedge

Lifecycle of Asian Hedge Funds

This section explores the trends in average age of hedge funds including liquidated funds. Figure 5 shows the population of live and dead hedge funds according to their age as at February 2011. We include dead funds in this analysis to counter the survivorship bias which would be inherent if this distribution was based entirely on live funds. The age-wise population of hedge funds shows a mean age of 3.7 years.

Table 4 shows the average age of dead funds[2] is increasing over the years which suggests that managers are increasingly able to develop successful strategies and hence, last longer by earning performance fees while also raising enough capital in the early years to hit their survival threshold.

Figure 5: Historical lifespan of Asian hedge funds

Table 4: Average life of dead funds over the years

Year of liquidation

|

Average life (years)

|

2002

|

2.0

|

2003

|

2.6

|

2004

|

2.6

|

2005

|

2.6

|

2006

|

3.6

|

2007

|

3.4

|

2008

|

3.6

|

2009

|

4.3

|

2010

|

4.4

|

February 2011

|

5.4

|

Average

|

3.4

|

Source: Eurekahedge

Fund Sizes

There have been significant changes to the composition of the Asian hedge fund industry over the last two years in terms of fund size.

Figures 6a-6c show the composition of the Asian hedge fund sector by fund size in February 2007, February 2009 and February 2011. In the last two years, the most significant change is the decrease in the number of small hedge funds with assets of less than US$20 million. The main reasons for this decrease in the population of small hedge funds since February 2009 are: a) redemptions from Asian hedge funds (during the financial crisis) continued until July 2009 and a number of small hedge funds closed shop; and b) the small funds that survived the financial crisis grew significantly during the subsequent recovery phase by posting strong performance-based gains while also attracting assets from investors and hence, were able to ‘graduate’ into the larger AuM categories.

This ‘promotion effect’ between 2009 and 2011 is also evident in the category of funds with more than US$200 million. The share of Asian hedge fund assets in this category has increased by 4% over the last two years.

Figures 6a-6c: Breakdown of hedge fund population by fund sizes

Geographical Mandates

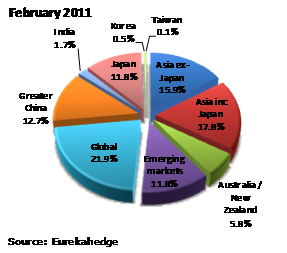

As Figure 7c demonstrates, the composition of the Asian hedge fund sector in terms of the geographic mandates of managers has also witnessed some significant changes over the last few years.

Prior to 2009, Japan-mandated funds had lost more than 56% of their share of the Asian hedge fund universe since 2007. That drop had been attributed to the exceptional growth in Asia ex-Japan hedge funds and three consecutive years of negative returns (between 2006 and 2008) by Japanese funds which led to investors allocating greater capital to other regions.

The trends over the last two years indicate an increase in the share of Asian assets managed by global funds. The main reason for this is that most of the capital allocated to hedge funds in general over the last two years has come from institutional investors, what have preferred to invest in large global-mandated funds to gain exposure to Asia. The drop in the share of funds investing with an Asia including Japan mandate is primarily due to the closure of a few large funds over the last two years as well as the greater relative growth of Asia ex-Japan and global funds.

Figures 7a-7c: Changes in the geographic mix of Asian hedge funds

by assets under management

Strategic Mandates

As shown in Figures 8a-ac, there has been a sizable dip in the number of Asian funds employing long/short equity strategies since 2007. Contrary to some suggestions, this was not only due to the global financial crisis; instead, this is a sustained trend through the years which can be attributed to the increasing availability of other strategies in the regional hedge fund space, greater access and easing of restriction in markets such as China and India, and the availability of more complex financial instruments in Asian markets.

Figures 8a-8c: Changes in the strategic mix of Asian hedge funds by assets under management

Head Office Location and Fund Domicile

The United Kingdom continues to hold the top place as head office location for Asian hedge funds (Figures 9a-9b), while the number of funds based in Asia has increased in Hong Kong and Singapore. However, the US and Australia have both lost ground. It is likely this trend has occurred because a number of older Asian hedge funds were set up in the US initially and have since moved to Asia as the region has developed a robust investor base. The continued expansion of service providers and an increasingly large, financially trained, workforce have also helped this move towards Asian-based funds.

Between Hong Kong and Singapore, Hong Kong continues to be the larger market. Hong Kong has come out of the global financial downturn with more than 250 hedge funds and can boast a wide-range of hedge fund service providers and investors, making it an attractive location for managers.

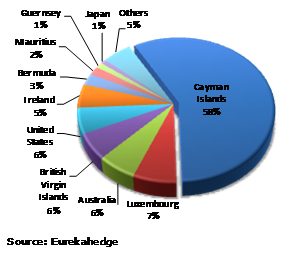

In terms of fund domiciles of Asian hedge funds, the Cayman Islands continue their dominance, with 58% of managers choosing the location to set up their hedge funds. Cayman offers friendly regulations to funds as well as ease of fund set-up featuring a large number of service providers, such as law firms, accounting firms and administrators. As tougher regulations continue to be introduced in the US and Europe, we expect Cayman-domiciled funds to remain in their dominant position for some time to come.

Figures 9a-9b: Head office location by number of funds

Figure 9c: Fund domiciles by number of funds

Fee Structure

The fee structures of newly launched Asian hedge funds have indicated a downward shift from pre-financial crisis to post-crisis, although the changes are not as dramatic as certain outlets have reported. Following the Madoff scandal and the significant fall in assets of the hedge fund industry during the global financial crisis, there has been a clamour by investors, as well as regulators, for a lowering of fees charged by hedge fund managers. While investors have been sceptical of paying a significant portion of their profits as performance fees, regulators raised the concern that high performance fees encouraged risk-taking by hedge fund managers. However, it should be noted that most hedge fund managers have a significant proportion of their own personal wealth tied up in the fund which discourages large risky bets.

Table 5: Asian hedge fund fees by launch year

Year

|

Performance Fees (%)

|

Management Fees (%)

|

2000

|

19.48

|

1.49

|

2001

|

19.75

|

1.47

|

2002

|

19.82

|

1.54

|

2003

|

18.61

|

1.47

|

2004

|

19.75

|

1.58

|

2005

|

19.42

|

1.73

|

2006

|

18.78

|

1.62

|

2007

|

19.08

|

1.84

|

2008

|

18.86

|

1.68

|

2009

|

17.94

|

1.66

|

2010

|

18.56

|

1.59

|

Feb 2011

|

18.41

|

1.49

|

Source: Eurekahedge

Average management fees have remained more or less consistent, primarily because they are reasonable and competitive with the fees charged by other investment vehicles such as mutual funds. However, the performance fees breakdown of hedge funds has also shown some variance over the years. As with management fees, while a traditional mark (20% in this case) remains the most widely practiced performance-based charge, the proportion of funds charging less than that has increased since the financial crisis. As managers struggled to raise cash for their funds, they started to take measures in order to attract greater capital. Additionally, there are also some funds that state 20% as the performance fee but are open to amending this on a case-by-case basis, depending on the profile of the investor as well as the amount of capital being allocated. A number of managers have been willing to accept a lower performance-based cut if the investors agree to longer lock-up periods and/or allocate a greater sum of capital. A simultaneous increase in the number of funds charging 0% performance fees also points to the evolving nature of the Asian hedge fund industry as managers employ different structures. Most of the funds charging 0% performance fees also have share classes, or other funds run by the same managers, that do charge a performance fee.

One interesting point to note is the growth in the number of funds that charge very high performance fees (25% or more). These funds are mostly run by either managers/traders who performed very well through the financial crisis or by research scientists and subject matter experts in the relevant sectors as they can leverage their reputation to demand higher compensation.

Service Providers

Prime Brokers

Tables 6a-6b: Market share of top Asian hedge fund prime brokers by assets under management

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Eurekahedge

The changes observed in the Asian hedge funds prime brokerage industry suggest a move towards greater diversity versus three years ago. Before the financial crisis, the top 2 prime brokers of Asian hedge fund launches accounted for more than 53% of the funds; however, in the last two years, the space has seen more equitable distribution among large institutions and the combined share of the top 2 prime brokers has decreased by nearly 10%. It should be mentioned that before the financial crisis, it was principally the prime brokers that had put in measures for counterparty risk; however, since then, fund managers have also become wary of their dependence on prime brokers and have diversified their businesses across the different service providers, with the majority of funds utilising more than one prime broker. Furthermore, the share of ‘Others’ has also decreased suggesting that managers prefer working with better known and financially stable prime brokers. Additionally, a number of smaller hedge funds have turned to mid-tier prime brokers capable of imitating the product offerings of larger firms while providing more personalised solutions and paying greater attention to the smaller funds. In Tables 6a-6b, we have added a separate count for each of the prime brokers for instances where funds have reported multiple brokers.

Goldman Sachs continues to retain the top position; however, Morgan Stanley had edged ahead for a while in 2010. Deutsche Bank increased its share of Asian hedge fund business by almost 5% since 2007, thanks to its increased focus on the sector and its enhanced reputation after deftly navigating through the financial crisis. Deutsche Bank has reported an increase in assets under custody across Asia and is also actively marketing in countries such as Malaysia and Taiwan.

Administrators

As with prime brokers, the trend among the hedge fund administrators has been a move towards greater diversification. The most noteworthy trend is the almost 10% drop in the share of assets administered by ‘Others’, which includes in-house administration. The primary reason for this shift is the emphasis on regulations and transparency – no investor is ready to invest with managers who do not have the proper risk controls in place and reputed third-party administrators.

Tables 7a-7b: Market share of top Asian hedge fund administrators by assets under management

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Eurekahedge

Auditors

In the post-financial crisis and Madoff scandal, world investors demand that their funds utilise accredited third-party auditors. Even before the crisis, the Asian hedge fund industry had a well-developed regulatory landscape which effectively prepared the managers for the stress laid on regulation and disclosure requirements post-2008. Table 8 shows the top 10 auditors of Asian hedge funds by fund population.

Table 8: Top Asian hedge fund auditors by number of funds

Share of auditors in Asian hedge funds

| |

Ernst & Young

|

34.2%

|

PricewaterhouseCoopers

|

29.6%

|

KPMG

|

13.9%

|

Deloitte

|

10.7%

|

Moore Stephens

|

1.4%

|

BDO

|

1.2%

|

Grant Thornton

|

0.9%

|

McGladrey & Pullen LLP

|

0.9%

|

HLB Mann Judd

|

0.8%

|

Rankin Berkower

|

0.6%

|

Others

|

5.8%

|

Source: Eurekahedge

Unsurprisingly, the big four accounting firms dominate the hedge fund auditing business in Asia, with Ernst & Young coming out on top. Ernst & Young clearly considers the fund management sector as a very important part of their business in Asia and have focused on the sector to become the market leader. PricewaterhouseCoopers holds second place in the overall industry – the firm has an extensive network in Hong Kong with a number of veteran fund auditors on board, and they continue to build on their existing partnerships. On the other hand, KPMG has been making a big push in the hedge fund auditing business recently and has captured a greater share of the new business in Asia than it has historically enjoyed. Smaller auditing firms (those outside the ‘Big Four’) are attractive because of their lower cost structures, making them popular among smaller hedge funds

Tables 9a-9b: Top hedge fund legal advisors by number of funds

|

| ||||||||||||||||||||||||||||||||||||||||||||

Source: Eurekahedge

Hedge fund law firms provide specialised legal guidance to hedge fund managers on global investment management. Their services can range from setting up domestic partnerships to offshore companies and structures. We differentiate between offshore and onshore advisors to highlight the specialisation regions of firms as well as the services that they offer, which can include registration, organisational set-up, drafting disclosure documents, investor advisory agreements and liability language.

Offshore legal advisors provide an array of services in company, trust and fund formation in various offshore locations such as Cayman Islands and the British Virgin Islands. Traditionally, the choice of legal firm has been driven by the location selection; for example, some firms would be specialised in setting up Cayman Islands offshore structures and these would form the natural choice of a new fund looking to set up on the Islands. However, it seems that post-financial crisis, new managers have started to take other things into consideration as well. In addition to legal services, some firms also provide other fiduciary services such as administrations and due diligence checks, which not only provides a one-stop-shop for new managers but can also make greater sense economically.

Performance Review

In this section, we compare the performance of Asian hedge funds with other investment vehicles and underlying markets over various time periods as at end-February 2011. We will also look at how different sectors within Asia have performed in terms of sub-regions and single countries as well as strategies and different fund structures.

Asian hedge funds have delivered some notable performances over the last few years, with their 2010 return standing at 8.69%. In 2009, the Eurekahedge Asian Hedge Fund Index gained a massive 26.93% return, the best return on record for the index, outperforming most other regional hedge fund indices that year. Figure 10 shows the performance of Asian hedge funds along with Asian funds of hedge funds, Asian long-only absolute return funds and global hedge funds since the end of 2006.

Figure 10: Performance of Asian hedge funds and other investments since end-2006

Compared with other alternative investment vehicles within Asia such as long-only absolute return funds, hedge funds have consistently delivered better returns with lower volatility and downturn protection. Over the last four years, Asian hedge funds increased 28.07% while funds of hedge funds returned only 4.69% and long-only absolute return funds gained 12.88%. This represents a remarkable recovery from the financial crisis as well as outperformance to other investment vehicles. Although Asian hedge funds suffered losses of 21.00% in 2008, this also demonstrates significant downturn protection, as long-only absolute returns funds were down 44.83% in the same year while underlying markets suffered even greater losses. Global hedge funds have seen slightly better returns versus Asian hedge funds over this time period since they did not suffer losses of the same magnitude as Asian hedge funds in 2008. The main reason for this is that Asian hedge funds were primarily dominated by equity-based funds, which suffered greater losses as opposed to other strategies, while the global hedge fund sector has a greater mix of other strategies such as CTA/managed futures funds and macro hedge funds which helped to mitigate some of the losses suffered due to equity exposure in 2008.

Figure 11 tracks the performance Asian hedge funds versus the MSCI Asia Pacific Index since the end of 1999. The Eurekahedge Asian Hedge Fund Index gained 178.47% since inception while the underlying markets lost 9.31% over the same period. Hedge funds have consistently outperformed underlying markets over time but there were distinct periods at which hedge funds delivered significantly better results. For example, Asian stock markets experienced a drawdown of 48.05% during the 2000–2003 period while Asian hedge funds were up during the same time. Additionally, during the 2008 economic slowdown, hedge funds lost 21% of their NAVs on average while Asian stocks plummeted by 45.39%. This highlights the resilience of the Asian hedge fund industry during economic downturns and why they should figure as a necessary addition to a well-diversified portfolio.

Figure 11: Performance of Asian hedge funds and equities in the last 10 years

Figure 12 highlights the superior risk management capabilities of Asian hedge fund managers. The average annualised standard deviation of the Eurekahedge Hedge Fund Index is 7.60%, much lower than the 16.29% for Asian equities. Throughout this time, hedge fund managers have kept portfolio volatility to less than 15% on average, while comparatively, market volatility reached 35.55% in 2009. As such, not only have Asian hedge funds outperformed the underlying markets in the long and medium terms, they have done so with lower volatility, delivering consistent risk-adjusted returns as per their mandate.

Figure 12: 12-Month rolling standard deviations of Asian hedge funds and equities

Geographical Mandates

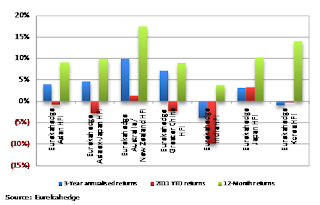

When considering the different geographical mandates within the Asian hedge fund landscape, funds investing in Australia & New Zealand have delivered the best returns over the last 12 months followed by Japanese hedge funds. Figure 13 shows the performance across different regions while Table 10 gives the different performance statistics.

Figure 13: Performance of Asian hedge funds across geographic mandates[3]

The excellent performance of Australian hedge funds over the last 12 months, up 17.46%, highlights the skill of regional managers as the underlying markets have been very volatile – the ASX All Ordinaries Index is up only 4.18% over the last 12 months. Most Australian hedge funds strengthened their risk management following the financial crisis and a number of them have mentioned this, adding substantial value to their stock selection processes. Managers who outperformed significantly delivered gains from exposure to mineral resources, mid-small cap companies as well as the services sector and healthy corporate activity. Australian hedge funds also delivered the strongest gains among Asian hedge funds for 2010 as well as in the 3-year annualised return measure.

Japanese hedge funds also delivered outperformance to their Asian peers and to the underlying markets with a return of 10.26% over the last 12 months – the Nikkei advanced 0.74% in comparison. Managers investing in the small-cap sector raked in the largest gains while a strong corporate activity environment also proved beneficial for funds in the event driven space over the last 12 months. In terms of 2010 performance, Indian hedge funds provided the best returns, albeit with the highest volatility.

Table 10: Performance across Asian geographic mandates

Asian HF

Index

|

Asia ex- Japan HF Index

|

Australia/NZ

HF Index

|

Greater China

HF Index

|

India HF

Index

|

Japan HF Index

| |

12-Month returns

|

9.14%

|

9.92%

|

17.46%

|

8.94%

|

3.83%

|

10.26%

|

3-Year annualised returns

|

3.99%

|

4.71%

|

9.95%

|

7.15%

|

-3.96%

|

3.12%

|

3-Year annualised standard deviation

|

10.25%

|

13.10%

|

11.02%

|

14.42%

|

24.74%

|

7.46%

|

2011 YTD returns

|

-0.85%

|

-2.81%

|

1.40%

|

-2.29%

|

-9.93%

|

3.42%

|

2010 Returns

|

8.69%

|

10.72%

|

12.84%

|

9.02%

|

13.28%

|

8.48%

|

Based on performance as at end-February 2011.

Source: Eurekahedge

Strategic Mandates

Figure 14: Asian hedge fund performance by strategy[4]

In terms of strategic mandates, all strategies delivered positive returns in the 12-month period and in the 3-month annualised return measure. The best performances were delivered by distressed debt and event driven managers, up 15.32% and 13.04%, respectively. Distressed debt managers have benefitted from the low interest rate environment since 2009, which helped to drive demand for higher yielding assets. Asia-investing distressed debt hedge funds profited from the improved credit market and managers who had taken positions in bonds trading at deeply discounted values early on have delivered hefty gains.

Event driven hedge funds capitalised on the robust corporate activity environment which provided managers with profit-making opportunities throughout the year. The gains were generated on the back of increased deal and IPO volume in 2010 – global deal volume for 2010 increased 22.4% year-on-year and total IPO volume in 2010 was US$269.4 billion.

Asian fixed income hedge funds have also fared well over the last 12 months with a gain of 12.11%. Top performing fixed income themes have been those focused on high yielding issues while the funds utilising leverage to amplify their gains have also delivered excellent returns. CTA/Managed futures funds remain ahead of the rest in the 3-year annualised return measure, primarily due to their outperformance in 2008 when they were up 10.22% at a time when most other strategies witnessed steep losses.

Table 11: Performance across Asian hedge fund strategic mandates

Arbitrage

|

CTA

|

Distressed debt

|

Event

driven

|

Fixed

income

|

Long/Short equities

|

Macro

|

Multi-

strategy

|

Relative

value

| |

12-Month returns

|

6.08%

|

4.14%

|

15.32%

|

13.04%

|

12.11%

|

8.88%

|

0.93%

|

7.61%

|

8.05%

|

3-Year annualised

returns

|

2.76%

|

10.22%

|

4.46%

|

6.94%

|

5.59%

|

3.50%

|

2.35%

|

2.84%

|

8.44%

|

3-Year Annualised standard deviation

|

5.31%

|

6.80%

|

4.77%

|

9.01%

|

8.05%

|

11.04%

|

4.82%

|

8.09%

|

7.48%

|

2011 YTD returns

|

0.10%

|

-2.18%

|

1.14%

|

1.16%

|

0.98%

|

-1.04%

|

-0.26%

|

-1.17%

|

-4.37%

|

2010 Returns

|

7.57%

|

4.94%

|

16.09%

|

12.46%

|

8.86%

|

7.96%

|

1.92%

|

8.30%

|

12.46%

|

Based on performance as at end-February 2011.

Source: Eurekahedge

Head Office Location

Table 12 shows the 2010 returns of hedge funds investing in Asia based on head office location. Although one would think that funds located closer to their region of investment would be in a position to deliver better returns, the distribution in Table 12 below suggests that a hedge fund’s office location does not have a great impact on the managers’ ability to generate returns. However, an interesting point to note is that Asia-focused hedge funds located in Australia and the United States have, on average, a greater asset base, and in 2010, larger hedge funds performed better than medium-sized and small hedge funds in Asia. Additionally, if we include long-only absolute return funds in this analysis, the 2010 return figures for Singapore- and Hong Kong-based funds improve significantly since there are a number of established long-only managers operating from these locations.

Table 12: 2010 Performance of Asian hedge funds by head office locations

Asian hedge funds

|

Asian long/short equity

|

Japan

hedge funds

|

Japan long/short equity

|

Greater China

hedge funds

|

Greater China long/short equity

| |

Australia

|

11.16

|

10.99

|

10.36

|

7.00

|

NA

|

NA

|

Hong Kong

|

8.91

|

7.13

|

7.52

|

6.92

|

10.83

|

9.43

|

Japan

|

5.39

|

3.88

|

5.55

|

4.00

|

NA

|

NA

|

Singapore

|

5.48

|

5.74

|

7.76

|

2.61

|

11.32

|

19.43

|

United Kingdom

|

8.10

|

7.38

|

8.94

|

7.94

|

-1.96

|

-1.96

|

United States

|

10.51

|

11.81

|

7.76

|

7.76

|

11.16

|

13.78

|

Source: Eurekahedge

Figure 15 shows the performance of Asian hedge funds over the last four years versus the performance fees charged by managers. With the exception of the funds that charged between 5% and 10% performance fees, the distribution suggests that hedge fund returns become less volatile as the performance fees increase. In fact, the average returns of funds that charge more than 25% have been positive for all previous four years, including 2008. It should be noted that although the size of average returns (both positive and negative) seems to diminish with increasing fees, this is primarily because the funds in the Eurekahedge database report their returns net of all fees.

Figure 15: Asian hedge fund performance vs performance fees

Figure 16 shows the performance of Asian hedge funds by redemption frequency over the last four years. The graph seems to suggest that funds with redemption frequency of less than two months provide better downside protection while funds with redemption frequency of two months have the greatest volatility. The volatility also seems to increase as redemption frequency increases.

Figure 16: Asian hedge fund performance by redemption frequency

Conclusion

The Asian hedge fund sector has witnessed significant changes since the financial crisis in terms of fund structures, investment geographies and strategies. The industry has trended towards implementing processes to meet new regulatory frameworks while also putting more stringent risk management practices in place. The service provider landscape has also witnessed trends to this effect, with managers opting for greater diversification among prime brokers and using proper renowned firms for administration and auditing.

In terms of performance, Asian hedge funds have delivered excellent returns post the financial crisis, which has helped the industry recover some of its asset base. Over the last 24 months, managers investing in Asia have displayed the skills to navigate through volatile markets and have outperformed other alternative investment vehicles. Although asset allocation activity has not been as strong as what was seen pre-2008, the sector has seen net positive asset flows since July 2009 and witnessed strong launch activity with the fund population now at a historical high.

Given the changes implemented by managers, excellent performance-based returns, continued investor interest in the region, and improving global economic outlook and investor sentiment, we expect 2011 to be a bumper year for the Asian hedge fund space in terms of capital raising and we predict the size of Asian hedge funds to reach a historical high of US$180 billion by the end of the year.

No comments:

Post a Comment