Introduction

The European hedge fund industry grew at a rapid pace in the first seven years of the last decade, with assets increasing 12-fold to reach US$464.30 billion at the end of 2007. Over the same period of time, the total number of hedge funds in the region increased six times to cross the 3,000 mark. However, as the global economy went into recession in 2008, European hedge funds went through their worst year on record, suffering heavy losses and witnessing unprecedented redemption pressure. This trend continued into the first few months of 2009, with industry assets reaching a trough of US$293.60 billion in March 2009, falling below the US$300 billion mark for the first time since 2005.

Figure 1a shows the growth in European hedge funds since 2000 while Figure 1b displays the movement in industry assets since June 2009.

Figure 1a: European Hedge Fund Industry Growth since 2000

Between April and December 2009, the industry posted a remarkable recovery, with managers posting healthy gains and attracting significant capital in the last eight months of the year. The Eurekahedge European Hedge Fund Index posted its highest annual return on record in 2009, gaining 20.25% and the region's hedge funds finished the year with assets under management standing at US$346.53 billion.

The fortunes of European hedge funds in 2010, however, has been mixed, with managers posting some healthy returns and offering downside protection while suffering from net negative outflows during the first eight months of the year (see Table 1).

|

Figure 1b: Assets in European Hedge Funds

|

Industry Make-Up and Growth Trends

The following pages discuss the asset flows to the industry in greater detail while looking at the changes in the industry over the years in terms of fund population, strategies employed, geographical mandates and manager locations.

Asset Flows

Assets under management in European hedge funds reached a maximum of US$472.4 billion in June 2008 as the industry witnessed strong sustained growth in the preceding years – the size of the European hedge fund industry increased 12-fold from 2000 until Jun-2008. In addition to attracting substantial capital, the region's hedge funds delivered excellent performance-based gains of nearly US$130 billion, with the Eurekahedge European Hedge Fund Index having posted seven years of back-to-back positive returns up to that point in time. However, in the face of heightened volatility across all asset classes and massive redemptions in 2H2008 and 1Q2009, industry assets shrank rapidly and fell to US$293.60 billion in March 2009.

The trend of redemptions turned around in May 2009 as the global economy started to post a recovery. European hedge funds attracted US$30.24 billion in the last eight months of 2009 and, while asset flows have not been so forthcoming in 2010, they remain positive as at end October. Table 1 shows the monthly asset flows in European hedge funds over the last two years.

Table 1: Monthly Asset Flows across European Hedge Funds between January 2009 and November 2010

Month

|

Net Growth

(Performance)

|

Net Flows

|

Assets at end

|

Jan-09

|

(0.2)

|

(20.5)

|

308.5

|

Feb-09

|

(0.7)

|

(10.3)

|

297.4

|

Mar-09

|

0.7

|

(4.5)

|

293.6

|

Apr-09

|

4.2

|

(3.9)

|

293.9

|

May-09

|

7.9

|

2.6

|

304.4

|

Jun-09

|

(1.3)

|

4.2

|

307.3

|

Jul-09

|

3.5

|

2.5

|

313.3

|

Aug-09

|

4.4

|

5.8

|

323.5

|

Sep-09

|

6.1

|

7.5

|

337.2

|

Oct-09

|

(1.7)

|

6.1

|

341.5

|

Nov-09

|

2.1

|

2.2

|

345.8

|

Dec-09

|

1.3

|

(0.6)

|

346.5

|

2009

|

26.3

|

(8.9)

|

346.5

|

Jan-10

|

0.3

|

(2.0)

|

344.8

|

Feb-10

|

(0.0)

|

(1.6)

|

343.1

|

Mar-10

|

7.2

|

1.1

|

351.5

|

Apr-10

|

1.8

|

(1.8)

|

351.4

|

May-10

|

(5.7)

|

(5.7)

|

340.0

|

Jun-10

|

(0.6)

|

(3.2)

|

336.2

|

Jul-10

|

2.9

|

8.4

|

347.5

|

Aug-10

|

1.9

|

(0.6)

|

348.8

|

Sep-10

|

6.0

|

7.7

|

362.6

|

Oct-10

|

4.9

|

4.9

|

372.3

|

Nov-10

|

(0.5)

|

(1.1)

|

370.8

|

Source: Eurekahedge

Launches and Closures

Figure 2: Hedge Fund Launches and Closures between 2005 and October 2010

The European hedge fund population has witnessed some interesting trends in terms of fund launches and closures. The drying up of liquidity, market turbulence leading to losses and unprecedented redemption pressure in 2008 spiked up the fund attrition rate in 2008, which exceeded the number of launches during the year for the first time on record. Although the rate of closures remained high in 2009, launch activity picked up strongly in the year, primarily on the back of demand for UCITS III hedge funds[1]. This trend of healthy launch activity has continued in 2010, with nearly 370 new funds launched during the first 10 months of the year. Of the 831 funds launched in 2009 and 2010, about 60% were UCITS hedge funds.

Fees

Since the financial crisis, the Madoff scandal and the subsequent significant fall in assets of the global and European hedge fund industry there has been a momentous clamour by investors for a lowering of fees charged by hedge fund managers. In Table 2, we can see how fees have fallen over the last few years. Although average management fees have remained consistent, primarily because they are in line with the management fees of other investment vehicles such as mutual funds, the performance fees of hedge funds have varied over the years. The most significant drop in the performance fees occurred in 2008, when managers, struggling to raise cash for their funds, started to take measures to attract greater capital.

Table 2: Fee Structure of European Hedge Funds between 2004 and October 2010

Year

|

Average Performance Fee of Launches (%)

|

Average Management Fee of Launches (%)

|

2004

|

19.41

|

1.59

|

2005

|

19.99

|

1.56

|

2006

|

18.60

|

1.61

|

2007

|

18.32

|

1.64

|

2008

|

17.58

|

1.59

|

2009

|

17.16

|

1.61

|

As of October 2010

|

17.64

|

1.69

|

Source: Eurekahedge

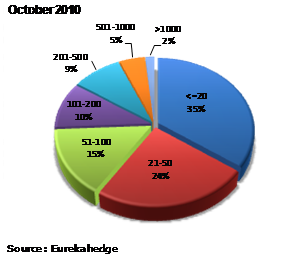

Funds by Size

Looking at the breakdown by fund sizes, the European hedge fund industry has undergone considerable changes over the past few years. As discussed in the Asset Flows section, the sector's excellent performance-based growth, as well as healthy asset flows in the years preceding the financial crisis, led to proportional changes in the sizes of hedge funds. By the end of 2007, 37% of the region's funds managed more than US$100 billion. However, widespread redemptions and performance-based losses in 2008 and early 2009 largely reversed the growth witnessed in the previous four years. The current make-up of the industry is quite different from the landscape in 2007 – the proportion of billion-dollar hedge funds has halved as funds lost their assets either through performance or outflows (or both) and, hence, got ‘demoted' into lower categories. Similar reasons account for the decrease in the share of funds managing between US$100 billion to US$500 billion. The share of small hedge funds managing less than US$50 million increased by 12% to account for nearly 60% of the industry.

It would be inaccurate to attribute these trends solely to outflows and losses witnessed during the financial crisis. The popularity of UCITS III hedge funds[2] in Europe spawned a large number of start-ups over the last two years. For these funds, asset raising has been tough because of the overall market sentiment and predilection among investors to allocate to larger, better-known hedge fund names. Going forward we expect this breakdown to shift in favour of increasing the number of larger funds, in anticipation of better subscription activity in 2011. Hedge fund allocations are predicted to increase in Europe as investors look for investment vehicles that can provide diversification, exposure to growth regions, along with downturn protection.

Figures 3a-3b: A Comparative Breakdown of European Hedge Funds by Fund Size

Strategic Mandates

The breakdown of European hedge funds according to strategic mandates has undergone some interesting changes since 2007. Although long/short equity retains its place as the most popular hedge fund strategy in Europe, it has lost 5% of its share between Oct-2007 and Oct-2010 as the managers employing the strategy suffered a rough market conditions during the financial crisis. Hit with massive redemptions, they also had to endure tumbling equity markets, bans imposed on short-selling and heightened volatility across equity markets – all of which resulted in sharp losses.

Figures 4a-4b: Strategic Mandates Breakdown of European Hedge Funds

by Assets under Management

The strategies that have significantly increased their share of European hedge fund assets are CTA/managed futures funds and event driven funds. CTA/managed futures was the only strategy that ended 2008 with a positive return; their share of the market increased relative to other strategies which all ended the year with negative returns. European event driven funds witnessed direct growth in 2009 and 2010 with excellent performance-based gains and healthy positive flows – the Eurekahedge Europe Event Driven Hedge Fund Index was up a strong 29.35% in 2009 and is the best performing hedge fund index in Europe in 2010.

Geographical Mandates

The breakdown of European hedge funds by geographical mandates is split into the six categories as shown in Figures 5a and 5b.

Figures 5a-5b: Geographical Mandates of European Hedge Funds

by Assets under Management

The geographical mandates breakdown shows that only a small proportion of assets are purely allocated to Europe while the majority of the funds function with a global mandate. This is primarily because most European hedge funds allocate to markets such as the US, amongst others, and a global mandate helps them in their search for opportunistic investments regardless of geographical restrictions.

The major change seen over the last few years has been the 9% increase in the assets of global- investing hedge funds, coming mostly at the cost of assets allocated to Europe. The primary reason for this is that funds with broad mandates delivered better performance through the financial crisis and as such, their losses were not as great as Europe-specific investments. This difference in performance further translated into lesser redemptions in 2008 and early 2009 and also led to inflows in 2009 and 2010.

Head Office Location and Fund Domicile

The European hedge fund head office location distribution has not displayed any significant changes over the last few years, with the United Kingdom remaining home to 48% of European managers. With the increase in the number of onshore UCITS hedge funds[3], France and Luxembourg are becoming increasingly popular hedge fund centres. A more pronounced effect of the UCITS phenomenon has been the change in European hedge fund domicile breakdown. The UCITS regulation requires participant hedge funds to be domiciled within Europe; as such, a significant number of European hedge funds have changed their domiciles to onshore locations while most of the new launches are domiciled within Europe. This has resulted in the increased share of Ireland and Luxembourg domiciled funds and we expect this trend to continue through 2011.

Figure 6: Head Office Location and Fund Domicile by Number of Funds as of October 2010

Service Providers

The service provider landscape of the European hedge fund industry has also witnessed some changes over the last few years. The collapse of two large financial institutions and the subsequent financial crisis had some distinct effects on European hedge funds' approach towards service providers.

Prime Brokers

One of the drivers of change within the prime broker industry has been the recognition by hedge fund managers of counterparty risk posed by prime brokers, which was highlighted by the crash of Lehman Brothers. This culminated in a drive for diversification, with many hedge funds choosing to opt for two or more prime brokers post-2008, whereas earlier, most hedge funds had only one prime broker. This trend is shown by the more equitable distribution of hedge fund assets among the different prime brokers in 2010 versus 2008. Tables 3a and 3b show the top 10 prime brokers by assets under management in 2008 and 2010, respectively.

Tables 3a-3b: Market Share of the Top 10 Prime Brokers by Assets under Management

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Eurekahedge

Administrators

Tables 4a-4b shows the top five administrators by hedge fund assets in 2008 and 2010. Although the top five administrators remain the same, they have collectively lost some market share, which at first may seem surprising, given the emphasis placed on hedge fund managers to have proper third-party administrators. However, the healthy launch activity in 2009 and 2010 has resulted in a number of smaller hedge funds that have not yet been able to raise significant assets and thus cannot afford top tier administrators, thereby explaining the loss of market share by the top 5.

Tables 4a- 4b: Market Share of the Top 5 Administrators by Assets under Management

|

| ||||||||||||||||||||||||||||

Source: Eurekahedge

Performance Review

In this section, we discuss the performance of European hedge funds over the last three years, breaking it down in terms of different strategies employed and regional mandates of the funds. Figure 7 shows the performance of the Eurekahedge European Hedge Fund Index, the MSCI Europe Index[4] and Eurekahedge Europe Long-Only Absolute Return Fund Index since October 2007.

Figure 7: Performance of European Hedge Funds versus Other Investment Vehicles

Among the three different investment vehicles, European hedge funds show the best performance over the last three years, witnessing the smallest drawdown and recovering from the downturn ahead of the rest. As shown in Figure 7, out of the three indices under question, the Eurekahedge European Hedge Fund Index is the only index with value higher than what it was in October 2007.

Table 5 gives the key statistics for the indices in question. Not only have the regional hedge funds outperformed the underlying markets and long-only funds, they have also done so with greater stability of returns. In addition to witnessing the smallest drawdown over the three years, European hedge funds were also able to capture most of the upside in trending markets in 2009. The negligible underperformance of hedge funds to equities in rallying markets is more than offset by their substantial downside protection, as shown by 2008 returns, suggesting that hedge funds are superior to direct equity investments, investing through ETFs or other investment vehicles.

Table 5: Performance Statistics of European Hedge Funds and Other Investment Vehicles

Eurekahedge European

Hedge Fund Index

|

MSCI Europe4

|

Eurekahedge Europe

Absolute Return Index

| |

12 Month Returns

|

7.21%

|

8.84%

|

10.38%

|

3-Year Annualised Returns

|

0.70%

|

-10.71%

|

-4.93%

|

3-Year Annualised Standard Deviation

|

8.60%

|

20.93%

|

14.33%

|

Maximum Drawdown (3 Years)

|

-21.00%

|

-52.53%

|

-40.01%

|

YTD 2010 Returns

|

5.67%

|

2.23%

|

6.32%

|

2009 Returns

|

20.25%

|

23.39%

|

23.73%

|

2008 Returns

|

-18.89%

|

-40.93%

|

-24.42%

|

Sources: Eurekahedge and MSCI

Geographical Mandates Performance

The breakdown of European hedge funds performance by geographical investments shows a distinct difference across the spectrum, indicating the diversity of the sector. Figure 8 displays this graphically while Table 6 gives the key statistics breakdown across the different geographic mandates.

Figure 8: Performance across Geographical Mandates

In 2010 and in 2009, European hedge funds allocating to Eastern Europe and Russia have been the best performers amid massive returns in the underlying markets – the MSCI Eastern Europe Index was up 66.20% in 2009. However, it should be noted that these funds also witnessed the greatest volatility of returns and the largest drawdown in 2008 among all regional mandates and as such, their average three-year annualised returns remain in the red.

The performance of Europe and global-mandated funds, which together account for 79% of European hedge fund assets, shows some interesting trends as well. Although the return profiles of the two investment mandates have been similar over the last three years, global-investing funds have, on average, outperformed Europe-investing funds in almost all measures (except 2009 returns), as shown in Table 6. Managers investing with broader mandates generally tend to outperform in times of higher volatility and provide downturn protection. This has been one of the main reasons why investors have preferred to allocate greater capital to global-investing funds over funds focused on one particular region or country.

Table 6: Performance across Geographical Mandates

EHF Europe-Investing Hedge Funds

|

EHF Global-Investing Hedge Funds

|

EHF Emerging Markets-Investing Hedge Funds

|

EHF Eastern Europe- and Russia-Investing Hedge Funds

|

EHF Middle East- and Africa-Investing Hedge Funds

| |

12-Month Returns

|

5.97%

|

7.84%

|

10.31%

|

14.57%

|

5.26%

|

3-Year Annualised Returns

|

1.39%

|

3.92%

|

0.77%

|

-6.37%

|

-4.82%

|

3-Year Annualised Standard Deviation

|

6.02%

|

5.57%

|

13.28%

|

26.24%

|

10.90%

|

Maximum Drawdown (3 Years)

|

-13.54%

|

-9.37%

|

-30.02%

|

-59.59%

|

-26.15%

|

YTD 2010 Returns

|

4.73%

|

6.17%

|

6.74%

|

11.23%

|

7.25%

|

2009 Returns

|

14.03%

|

11.77%

|

34.00%

|

58.80%

|

-13.35%

|

2008 Returns

|

-11.28%

|

-5.22%

|

-27.54%

|

-55.11%

|

-9.55%

|

Source: Eurekahedge

Strategic Mandates Performance

All strategic sub-indices of European hedge funds delivered positive returns in 2009 while their year-to-date October 2010 performance remains healthy. Figure 9 shows the returns spectrum of European hedge fund strategies while Table 7 gives the key statistics.

Figure 9: Performance across Strategic Mandates

The best performers among European hedge funds have been the managers employing the event driven strategy. Event driven managers have posted excellent gains in 2009 and 2010 on the back of resurgent corporate activity. In the aftermath of the financial crisis, companies with strong balance sheets actively sought out deals for smaller firms with unusually low valuations, culminating in excellent returns for hedge fund managers operating in the M&A and corporate actions space. The Eurekahedge Europe Event Driven Hedge Fund Index gained a record 29.35% in 2009 and is up 12.50% in YTD October 2010.

European CTA managers have delivered the most consistent returns over the last three years, with their average three-year annualised returns almost at par with event driven funds. More tellingly, they achieved this return with half the volatility as that of event driven funds. Although the yearly returns are comparatively conservative, the consistency offered by CTA/managed futures funds culminates into substantial risk-adjusted performance over the longer term.

Other strategies have also posted healthy returns in 2010, with managers delivering excellent downturn protection earlier in the year when the regional markets remained on the edge due to fears of the European debt contagion. Fixed income managers understandably edged ahead of the rest early on in the year as the markets were dominated by low risk appetite, which translated into increased demand for safer investments. With a steady stream of positive economic news, market sentiment turned around in 3Q2010, leading to rallies in the underlying markets. We expect the regional managers of all strategies to finish 2010 in positive territory, with the average manager delivering between 6-8% return for the year.

Table 7: Performance across Strategic Mandates

Eurekahedge Europe Arbitrage Hedge Fund Index

|

Eurekahedge Europe CTA/ Managed Futures Hedge Fund Index

|

Eurekahedge Europe Event Driven Hedge Fund Index

|

Eurekahedge Europe Fixed Income Hedge Fund Index

|

Eurekahedge Europe Long / Short Equities Hedge Fund Index

|

Eurekahedge Europe Multi-Strategy Hedge Fund Index

| |

12-Month Returns

|

7.17%

|

4.07%

|

15.83%

|

10.11%

|

6.40%

|

8.10%

|

3-Year Annualised Returns

|

-1.43%

|

6.08%

|

6.42%

|

3.72%

|

0.32%

|

-2.24%

|

3-Year Annualised

Standard Deviation

|

8.64%

|

5.38%

|

10.16%

|

8.85%

|

8.97%

|

12.07%

|

Maximum Drawdown (3 Years)

|

-27.90%

|

-5.45%

|

-18.93%

|

-21.27%

|

-21.70%

|

-30.84%

|

YTD 2010 Returns

|

6.31%

|

3.79%

|

12.50%

|

8.83%

|

4.81%

|

7.92%

|

2009 Returns

|

11.92%

|

7.75%

|

29.35%

|

25.98%

|

20.60%

|

19.25%

|

2008 Returns

|

-16.31%

|

0.55%

|

-14.59%

|

-16.56%

|

-19.24%

|

-27.24%

|

Source: Eurekahedge

[1] UCITS is an acronym for “Undertakings for Collective Investment in Transferable Securities”, an EU collective investment regulation. For more information on UCITS hedge funds, please read the ‘Eurekahedge Key Trends in UCITS Hedge Funds’ feature published in the September 2010 edition of The Eurekahedge Report.

[2] For more details on the development of UCITS III hedge funds, please refer to the ‘Eurekahedge Key Trends in UCITS Hedge Funds’ feature published in September 2010 edition of The Eurekahedge Report.

[3] For more details on the development of UCITS III hedge funds, please refer to the Eurekahedge Key Trends in UCITS Hedge Funds feature published in the September 2010 edition of The Eurekahedge Report.