Introduction

Global fund of hedge funds have witnessed a dramatic change of fortunes over the last two and a half years. The industry grew at a steady pace between 2003 and early 2008, with assets under management peaking at US$826 billion, before suffering considerable losses and widespread redemptions[1] amid the global financial crises. After losing US$393 billion between March 2008 and July 2009 – a drawdown of nearly 48% – industry assets seem to have stabilised around the US$450 billion mark. Performance has also been healthy in 2009 and 2010 – the Eurekahedge Fund of Hedge Funds Index was up 9.39% in 2009 and 1.54% in year-to-date September 2010.

The figures below show the growth in the fund of funds industry over the years.

Figure 1a: Industry Growth over the Years

After witnessing massive outflows in 2008, which were exacerbated by poor performance and some high-profile frauds, total AuM in the funds of hedge funds industry fell to US$433.7 billion by July 2009. However, the trend of redemptions slowed down as the global economy recovered from the downturn and multi-managers started to post some positive results. Nevertheless, subscriptions remained weak through most of 2009 because of scepticism among the investors who had previously suffered due to losses or lock-ups.

While the first half of 2010 witnessed a continuation of flat to negative net flows, the third quarter saw net assets increase through positive performance and net subscriptions.

|

Figure 1b: AuM Growth in Recent Months

|

In the wake of the financial crisis, multi-managers have addressed several concerns raised by investors such as fee structures and redemption periods. In addition to discussing the key trends in terms of strategies, manager location and performance, this report also takes a look at the various changes effecting the working of funds of hedge funds.

Industry Make-Up and Growth Trends

Asset Flows

Risk aversion triggered by harsh movements across some key asset classes and the credit crunch preceding the global financial crisis started to effect in the industry the form of redemptions through 2Q2008. However, the fall of some major financial institutions along with major financial frauds such as Madoff further intensified the situation, leading to massive withdrawals by investors in 4Q2008 through 1H2009. While the spate of redemptions stopped in 2H2009 amid the global economic recovery, the first half of 2010 witnessed another round of net outflows, albeit on a much smaller scale than what was seen earlier. The first half of the year was dominated by fears of a double-dip recession, stemming from the European debt contagion, which led to declining global markets and a spike in risk aversion.

Another reason for the weak asset flows to funds of hedge funds has been the increasing number of investors now allocating directly into hedge funds rather than going through multi-managers in their quest for better risk-adjusted returns (as shown in Figure 2). Significant outperformance by hedge funds in 2008 and 2009, as well as the attractiveness of having only a single layer of fees, contributed to this change in investor behaviour. However, as shown in Figure 3, stable and consistent performance has allayed investor concerns to some extent, and the last two months delivered net positive flows to the fund of funds industry.

Table 1 below shows the monthly asset flows across the fund of hedge funds industry since September 2008.

Table 1: Monthly Asset Flow in Funds of Hedge Funds

Month

|

Net Growth (Performance)

|

Net Flows

|

Assets at end

|

Sep-08

|

-34.2

|

-44.7

|

710.7

|

Oct-08

|

-28.5

|

-29.1

|

653.1

|

Nov-08

|

-9.6

|

-14.0

|

629.5

|

Dec-08

|

-9.9

|

-40.6

|

578.9

|

2008

|

-113.5

|

-116.3

|

578.9

|

Jan-09

|

2.9

|

-72.2

|

509.7

|

Feb-09

|

-0.7

|

-32.2

|

476.8

|

Mar-09

|

-0.5

|

-8.7

|

467.6

|

Apr-09

|

0.7

|

-14.6

|

453.7

|

May-09

|

10.0

|

-16.3

|

447.3

|

Jun-09

|

1.3

|

-6.2

|

442.5

|

Jul-09

|

4.5

|

-13.4

|

433.7

|

Aug-09

|

4.2

|

1.6

|

439.4

|

Sep-09

|

3.4

|

0.8

|

443.6

|

Oct-09

|

3.4

|

0.8

|

447.8

|

Nov-09

|

-0.2

|

-1.5

|

446.1

|

Dec-09

|

1.2

|

0.5

|

447.9

|

2009

|

30.2

|

-161.3

|

447.9

|

Jan-10

|

1.1

|

-1.9

|

447.0

|

Feb-10

|

-0.1

|

-5.7

|

441.3

|

Mar-10

|

0.3

|

-0.5

|

441.1

|

Apr-10

|

2.4

|

-0.9

|

442.6

|

May-10

|

1.3

|

-2.2

|

441.7

|

Jun-10

|

2.3

|

-0.9

|

443.1

|

Jul-10

|

1.9

|

-0.1

|

444.9

|

Aug-10

|

1.1

|

1.1

|

447.0

|

Sep-10

|

4.4

|

1.9

|

453.2

|

Figure 2: Comparative Asset Flows in Fund of Hedge Funds and Hedge Fund

Assets under Management since January 2008

Figure 2 shows the comparative asset flows to fund of hedge funds vs global hedge funds, displaying a clear preference among the investors for the latter. Figure 3 tracks the correlation between asset flows and performance – the blue line tracks the 3-month moving average of net flows (from Table 1) displaced by 2 months while the red line shows the Eurekahedge Fund of Funds Index. The pre-2009 trend suggests that investors have subscribed 2 months after periods of positive performance and redeemed 2 months after periods of negative performance at corresponding magnitudes to the underlying performance. However, while performance has been positive for most of 2009 and 2010, the negative to flat asset flows are a manifestation of investor scepticism of the fund of hedge fund model post-Madoff and financial crisis. However, due to the consistent positive performance in the last two years, as well as other changes in the assets of funds of hedge funds, we expect allocations to turn positive in the near future.

Figure 3: 3-Month Average Net Flows vs Eurekahedge Fund of Funds Index Performance

Figure 4: Launches and Closures of Funds of Hedge Funds over the Years

The fund population of the industry has also gone through similar changes as AuM. While the number of funds grew exponentially between 2003 and 2007 to reach a maximum of 3,564, the attrition rate increased in 2008 and 2009. Currently, the global fund of funds population stands at 3,311 funds, and it is still decreasing. Figure 4 shows the number of funds that have started up and closed over the last two years; although the wholesale closure of multi-manager shops is over, the number of launches still lags behind the attrition rate. However, we expect the launch-closure ratio to even out through the next few quarters as the multi-managers have started to address various investor concerns, as shown in the next section.

Fees

The additional layer of fees charged by funds of hedge funds has been questioned by investors during and after the financial crisis, especially when considering their underperformance to hedge funds. As a response, managers moved to adjust the performance fees – Table 2 shows the average performance and management fees of funds launched in the last few years. The average performance fee of new funds of funds fell below 9% in 2008, and dropped to 7% in 2009, suggesting that multi-managers have been willing to further lower their cut to become more competitive, attract more capital and pass greater profits to their investors. While the average performance fee is back above 9%, it is still below the average 10% that was seen in previous years.

The management fee structure, however, has not changed much over the years as the average management fees since 2005 through 2010 are still within the fund industry standard of 1-2%. The performance fees, as an additional layer to the usual fees charged by traditional funds, now also include fees for increased due diligence and risk management requirements (which investors are willing to bear) as well as increased research and scrutiny of single-manager background, qualifications and past track record. As such, the decrease in the performance fees coupled with an increase in the services rendered by multi-managers shows the commitment in the fund of funds industry to meet the enhanced requirements of their investors.

Table 2: Average Fund of Hedge Fund Fees by Launch Year

Year

|

Average Performance Fees (%)

|

Average Management Fees (%)

| |

2005

|

10.16

|

1.39

| |

2006

|

10.03

|

1.32

| |

2007

|

9.38

|

1.30

| |

2008

|

8.92

|

1.40

| |

2009

|

7.00

|

1.37

| |

YTD September

|

9.16

|

1.40

| |

Redemption Frequency

In addition to revising the fee structures, multi-managers have also started to address other investor concerns. With an increasing number of investors choosing to allocate directly to hedge funds, multi-managers realised the need for better terms and conditions to remain attractive. One of the major concerns among the investors has been the redemption frequency of funds of funds – in 2008, a number of managers had put up gates and suspended redemptions, which left investors unable to pull their capital from falling markets. To allow investors greater access to their cash, multi-managers have moved to reduce their redemption frequency in 2009-2010. Table 3 shows the average redemption frequency of funds of funds launched over the last few years.

Table 3: Average Redemption Frequency by Launch Year

Fund Launch

|

Redemption Frequency (Days)

|

2005-2006

|

58

|

2007-2008

|

59

|

2009-2010

|

43

|

Regulations (UCITS)

Regulatory framework and transparency have also been among the major demands by fund of funds investors and as such, many managers have already started to adjust to the changed landscape by exploring the new UCITS framework and allocating to UCITS hedge funds. While providing greater transparency, structure, frequency of reporting and liquidity, this development also allows managers to explore new capital raising opportunities such as European pension funds.

Figure 5: Percentage of UCITS Funds in New Launches

Head Office Location

The breakdown of fund of funds population by head office location has witnessed some significant trends over the last five years. The US continues to be home to the most number of multi-managers, given the abundance of investors (to raise money from) and hedge funds (to invest in) in the region. However, its share of the population has decreased over the years while the share of European funds has increased. In fact, by mid-2008, the number of managers located in Switzerland had increased to account for 22% of the industry; however, Swiss multi-managers witnessed the greatest drawdown in terms of AuM (Figure 7) and the highest number of closures during the financial crisis.

Figures 6a-6b show the change in fund population by head office location while Figure 7 shows the launch activity over the years.

Figures 6a-6b: Head Office Location by Number of Funds

Figure 7: Office Locations of Launches by Number of Funds over the Years

Figure 8: Fund of Hedge Funds Assets under Management Growth

by Head Office Locations Post-Madoff

The four major fund of hedge funds centres have witnessed different growth trends since December 2008 (as shown in Figure 8). Switzerland- and UK-based funds witnessed the largest drawdowns due to their higher exposure to the Madoff ponzi scheme, which, in turn, led to continued redemptions through 2009. Furthermore, these funds had larger percentage of allocations from high-net-worth individuals as opposed to institutional investors and hence, a less sticky investor base. Furthermore, Figure 9 shows that European multi-managers also lagged behind their American and Asian counterparts in terms of performance. This was further compounded by the European debt contagion and fears of a double-dip recession which dominated market sentiment during the first half of 2010 and hence, also adversely effecting investor confidence.

Figure 9: Fund of Hedge Funds Performance by Head Office Location Post-Madoff

Geographic Mandates

Figures 10a-10b show the changes in the breakdown by exposure to regional hedge funds over the last five years. The notable changes are an 11% increase in assets invested into global hedge funds and a 7% decrease in capital allocated to North American funds. In addition to the general trend towards diversification, global-mandated hedge funds also protected capital allocated to them in 2008, losing a modest 2.7% in the year where most single-region mandates turned in double-digit losses. This outperformance led to further allocations to global funds in 2009 and 2010 as they were perceived as safer vehicles in times of high volatility.

Figures 10a-10b: Geographic Mandates by Assets under Management

Strategic Mandates

The changes in the breakdown of strategic mandates offer some surprising results, with macro-themed hedge funds losing nearly 12% of the total share of assets. Multi-strategy hedge funds, however, have increased to account for 16% of total fund of funds allocations, up from 4% in 2005. This change can be attributed to the flexibility offered by multi-strategy funds through the credit crunch, the financial crisis and the subsequent recovery as the underlying managers could trade across asset classes and employ various strategies available to them, and as such, delivering greater diversification. Event driven hedge funds have lost nearly 10% of the share, which is not surprising since the strategy tends to be rather illiquid and hence, not very compatible with the trend towards greater liquidity in the fund of funds industry.

Figures 11a-11b: Strategic Mandates by Assets under Management

Investment Guidelines

In addition to the changes in strategies and geographical investments, funds of hedge funds have also varied their guidelines on investing in start-up hedge funds. Figure 12 shows the percentage of multi-manager launches that were open to seeding hedge funds. The trend suggests a correlation with risk appetite as the years preceding the financial crisis saw an increasing number of funds of funds that would allocate to new hedge fund launches; however, 2008 and 2010 have gone against this trend as these years were marked by high risk aversion. More tellingly, if we compare the 2007 figure (pre-Lehman) with 2010 figure we see that 60% less fund of funds are now willing to seed hedge fund launches. Figure 13 shows head office locations of multi-managers that seed hedge funds based on the total fund of fund population as of end-September 2010.

Figure 12: Percentage of Fund of Hedge Funds Launches that Seed Hedge Funds

over the Years

Figure 13: Head Office Locations of Fund of Funds that Seed Hedge Funds

by Number of Funds

Service Providers

Over the last two years, the industry has also witnessed changes in the service provider landscape amid an environment of increasing regulations and investor demands for greater oversight of their assets. Given that the new regulatory framework in Europe and the US is still not fully deployed, the service provider landscape in the multi-manager industry will show further changes in the next two years. However, in the post-financial crisis environment, no investor will allocate to a fund that does not have accredited service providers – a comparison of 2008 (June) and 2010 data shows a distinct shift in this direction.

Auditors

Unsurprisingly, the Big Four come out on top in the market share breakdown of fund of funds auditors, with PricewaterhouseCoopers as the clear leader of the pack. The combined share of PwC, KPMG, Ernst & Young and Deloitte comes up to 82.1%. Table 4 lists the top 10 auditors by share of fund population. Interestingly, 2008 data showed that about 3% of the funds either had no auditor or internal auditors while in 2010, there are no such funds listed on the Eurekahedge database.

Table 4: Breakdown of Market Share of Auditors in the Fund of Funds Industry

by Number of Funds

Auditor

|

Market Share

|

PricewaterhouseCoopers

|

25.6%

|

KPMG

|

24.1%

|

Ernst & Young

|

18.6%

|

Deloitte

|

13.8%

|

Rothstein Kass

|

3.1%

|

Grant Thornton

|

1.8%

|

Anchin Block & Anchin

|

1.5%

|

McGladrey & Pullen LLP

|

1.3%

|

BDO

|

1.2%

|

Others

|

8.9%

|

Administrators

The breakdown of fund of funds administrators shows a much more diverse group, with the top 10 administrators accounting for less than 50% of the total population of multi-managers. The dynamics between funds of funds and administrators requires a more customised service as opposed to auditors, leading to managers working out specific relationships with different administrators. Additionally, smaller funds of hedge funds might not have the deal traffic to justify paying higher fees, and as such, would prefer to go with small administration shops. It should be mentioned here that the proportion of funds with internal administrators has nearly halved since June 2008, at which point, it was more than 8%.

Table 5: Breakdown of Market Share of Administrators in the Fund of Hedge Funds Industry

Administrators

|

Market Share

|

CITCO

|

14.58%

|

HSBC

|

9.61%

|

Prime Fund Solutions

|

4.77%

|

Citi

|

4.64%

|

CACEIS

|

3.25%

|

UBS

|

2.78%

|

BNY Mellon

|

2.72%

|

BNP Paribas

|

2.45%

|

PNC Global Investment Servicing

|

2.39%

|

Internal

|

4.87%

|

Others

|

47.85%

|

Performance Review

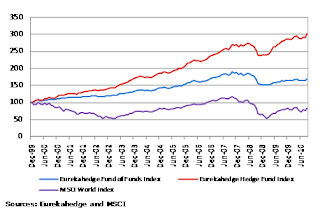

Over the last decade, funds of hedge funds have delivered consistent risk-adjusted returns to clients, posting positive performance for all years except 2008. Between 2000 and 2007, the Eurekahedge Fund of Funds Index gained 87.60%, and while this did not match the returns by hedge funds (169.49%), it represents a significant outperformance to the underlying markets which gained 11.82% over the same period. In 2008, the industry suffered its largest drawdown, with the average fund of funds losing 19.27% due to a combination of falling global markets, excessive redemptions, leading to forced liquidations, and exposure to fraudulent funds. However, despite all these challenges, multi-managers still outperformed global markets with comparatively smaller losses seen in the average portfolio. Furthermore, in 2009, despite continued requests for redemptions through most of the year, funds of funds delivered a healthy 9.4% return while in 2010, the performance has remained healthy, with the average multi-manager up 1.54% YTD September. Since its inception in December 1999, the Eurekahedge Fund of Funds Index has gained 68.2% while the MSCI World Index is down 17.0% – Figure 14 displays the performance of hedge funds, funds of hedge funds and underlying markets over the last decade.

Table 6: Performance of the Fund of Funds vs Other Investment Vehicles

EH Fund of Funds Index

|

EH Hedge Fund Index

|

Bespoke Mutual Funds Index

|

MSCI World Index

| |

12-Month Returns

|

2.77%

|

7.48%

|

3.02%

|

4.63%

|

2010 Returns

|

1.54%

|

4.93%

|

0.83%

|

0.92%

|

5-Year Annualised Returns

|

2.23%

|

8.38%

|

1.37%

|

-0.75%

|

Table 6 compares the short– and medium-term results of four investment vehicles. Funds of funds trail hedge funds in performance; however, the net positive numbers display the multi-managers' ability to preserve capital and attain consistent returns for clients. Overall, funds of funds are better considerations when compared with direct investment into markets and investing through mutual funds as they have outperformed both vehicles in 2010 as well as over the last five years.

Figure 15: Performance of the Fund of Funds vs Other Investment Vehicles

Figure 16: Rolling 12-Month Annualised Volatility of Funds of Hedge Funds

vs Other Investment Vehicles since September 2005

Figure 16 tracks the rolling 12-month annualised standard deviation of hedge funds and funds of hedge funds vs the MSCI World Index and mutual funds over the last five years. While all indices witnessed an increase in volatility between 2008 and 2009, alternative investments remained significantly less volatile than the underlying markets and mutual funds. The maximum difference in volatility occurred in the 12 months between September 2008 and September 2009 – mutual funds and equities displayed a 12-month annualised volatility of more than 30% during this period while hedge funds and funds of hedge funds remained below 10%. Over 2009 and 2010, funds of hedge funds have been less volatile than hedge funds, although they have also delivered lower returns. However, the stability of returns offered by funds of hedge funds makes multi-manager investments beneficial to a portfolio.

Figures 17 and 18 exhibit the distribution of monthly returns of hedge funds and funds of funds since 2000, while Table 7 details their average returns, skewness and kurtosis. Given the diversified nature of fund of funds investments, their returns distribution should theoretically be closer to normal, with less skewness and kurtosis than hedge funds; however, we find that the opposite is true – as such, funds of funds pose a greater risk of fat-tail events than single-manager hedge funds.

On a side note, hedge fund managers have, on the whole, displayed considerable skill over the last 10 years as their returns distribution is closer to normal than that of underlying markets with better mean and median returns – the MSCI World Index returns since 2000 have a mean value of -0.13% and a median of 0.48%.

Table 7: Skewness and Kurtosis in Funds of Hedge Funds and Hedge Funds

Monthly Returns Distribution since 2000

Median

|

Mean

|

Skewness

|

Kurtosis

| |

Funds of Hedge Funds

|

0.61%

|

0.41%

|

-1.25

|

4.42

|

Hedge Funds

|

1.04%

|

0.87%

|

-0.39

|

1.54

|

Figure 19: Performance of Fund of Funds Geographic Mandates

Table 8: Performance of Fund of Funds Geographic Mandates

EH Asia Pacific FoF Index

|

EH Emerging Markets FoF Index

|

EH Europe FoF Index

|

EH Global FoF Index

|

EH Japan FoF Index

|

EH North America FoF Index

| |

2010 Returns

|

0.58%

|

4.12%

|

0.82%

|

1.24%

|

1.85%

|

2.80%

|

12-Month Returns

|

2.58%

|

6.35%

|

1.11%

|

2.18%

|

0.89%

|

5.21%

|

5-Year Annualised Returns

|

3.09%

|

8.26%

|

0.95%

|

1.69%

|

-0.64%

|

3.16%

|

Breaking down the performance by geographic mandates, emerging market funds of funds have delivered the best returns in the short and medium terms as shown in Figure 19 and Table 8. The Index's 5-year annualised returns exceeded the second-best performer by 5.10%, which is mathematically a cumulative 28.24% at the end of five years – similar to the difference in performance of emerging market hedge funds and global hedge funds (31.53%) over the same period. The robust growth in emerging markets over the years has delivered excellent profits to hedge funds and hence, subsequently to funds of funds. Multi-managers investing in North America have also witnessed healthy returns – the Eurekahedge North American Fund of Funds Index is up 2.80% YTD September 2010. Multi-managers focusing on the North American hedge fund space have the distinct advantage of having a wide variety of funds to choose from, given that the region is home to the largest pool of hedge fund managers as well as some of the world's most famous and top performing alternative asset managers.

Figures 20a-20e show the performance of funds of funds and their respective underlying hedge fund geographic mandates. An interesting trend observed in the graphs shows that difference in performance between the two widens in bullish years and converges in bearish years. This means that hedge funds fall faster than funds of funds in downturns but produce greater returns per invested capital in good years – as such, displaying greater volatility. Another observation is that the average funds of funds always underperform hedge funds due to the extra layer of fees. While the difference in fees may seem insignificant in the short term, the compounding effect of time makes fees an important consideration in long-term returns.

Figures 20a-20e: Performance of Funds of Funds vs Underlying Hedge Funds

by Regional Mandates

Figure 21: Performance across Fund Sizes

Table 9: Performance across Fund Sizes

EH Small Global FoF Index ( < US$100m )

|

EH Medium Global FoF Index ( US$100m - US$500m )

|

EH Large Global FoF Index ( > US$500m )

| |

2010 Returns

|

1.14%

|

2.36%

|

2.78%

|

12-Month Returns

|

2.37%

|

3.77%

|

4.74%

|

5-Year Annualised Returns

|

1.89%

|

3.08%

|

3.40%

|

As shown in Figure 21 and Table 9, larger funds of funds have consistently outperformed their smaller counterparts in all time periods under consideration. The net asset value of large funds of funds (those managing more than US$500 million) has risen 89.2% since inception while the percentage rise for the smallest funds of funds amounts to 62.6% – a trend similar to that observed in hedge funds [2]. This is partially explained by the cycle of strong inflows into multi-manager platforms with greater fund capacities: larger funds of funds are able to invest into successful hedge funds, which typically require large minimum investments and longer lock-up periods, and hence, generate better performance, thereby attracting more capital. Also, a larger asset base enables multi-managers to maintain their positions in potentially winning hedge funds at times of high redemption requests. Other advantages include better liquidity terms to investors, economies of scale in terms of fees, risk management, compliance and administrative costs. Unfortunately, after Madoff, smaller funds see lower profit margins due to a rise in these overheads and which further translates into lower reported performance net of fees.

Figure 22: Performance of Funds of Funds Across Strategic Mandates

Table 10: Performance of Funds of Funds across Strategic Mandates

EH Arbitrage FoF Index

|

EH CTA FoF Index

|

EH Distressed Debt FoF Index

|

EH Event Driven FoF Index

|

EH Fixed Income FoF Index

|

EH Long / Short Equities FoF Index

|

EH Macro FoF Index

|

EH Multi-Strategy FoF Index

|

EH Relative Value FoF Index

| |

12-Month Returns

|

-1.48%

|

-0.57%

|

6.05%

|

4.62%

|

4.84%

|

1.99%

|

1.36%

|

2.95%

|

0.09%

|

2010 Returns

|

0.47%

|

0.78%

|

3.99%

|

2.62%

|

5.21%

|

0.82%

|

1.05%

|

1.49%

|

-1.08%

|

5-Year Annualised Returns

|

0.55%

|

5.28%

|

1.85%

|

1.75%

|

1.31%

|

1.48%

|

5.63%

|

2.17%

|

0.55%

|

Most fund of funds strategic mandates have posted healthy returns for 2010 with low volatility – in sharp contrast to other investment vehicles. Multi-managers investing in fixed income strategies have been the best performers in 2010 and in the 12-month returns measure. Fixed income funds of funds have garnered gains in excess of 5% YTD as underlying fixed income hedge funds delivered performance of more than 8% in this period. Multi-managers allocating to distressed debt have witnessed the largest profits in the last 12 months as the Eurekahedge Distressed Debt Funds of Funds Index beat the average fund of funds by nearly 4%. Distressed debt hedge funds have been on a winning streak in the last two years and remain as the best performing hedge fund strategy in 2010.

Performance across strategic mandates looks better in the longer 5-year time period. All the multi-managers posted positive returns with macro- and CTA-investing funds of funds dominating the top spots. The Eurekahedge CTA Fund of Funds Index witnessed a 5-year annualised return of 5.28% while macro funds of funds had a 5-year annualised return of 5.63%. The underlying single-manager hedge funds steered their way through the financial downturn more successfully than other strategic hedge funds and thus, were able to generate higher returns in the longer term.

Conclusion

Funds of hedge funds have seen some progress in their recovery from the heavy losses and massive redemptions suffered in 2008. Performance in 2009 and 2010 has been healthy, although they have not matched the returns posted by hedge funds. However, multi-managers have started to address the concerns raised by investors in terms of fee structures, transparency, regulations, risk management and fund administration. The combined effect of these changes and improved performance has resulted in capital starting to trickle back into the industry for the first time since Madoff, albeit at a marginal rate.

To be able to reach their historical asset levels, funds of hedge funds will have to either raise their performance or present investors with a greater value proposition in terms of stability of returns. The industry's performance in 2008, as well as the gated redemptions, led to many previous fund of funds investors to lose faith in the multi-manager model. While the changes in fees and transparency are a good start, funds of hedge funds need to show significant incentives to lure those investor back in and to see inflows similar to those in the pre-2008 period.

Going forward, we anticipate allocations to pick up through 4Q2010 as the trend of redemptions is now over and investors start to reallocate to fund of hedge funds again. We also expect performance in the fourth quarter to be stable, with the funds of hedge funds finishing the year with a 5-6% return and assets around US$465 billion.

[1] For a detailed analysis on the fund of hedge funds losses in 2008-2009, please refer to the Eurekahedge 2009 Key Trends in Funds of Hedge Funds Report.

[2] Please refer to the recently published Eurekahedge 2010 Key Trends in Global Hedge Funds report.

Investment funds services in UAE

ReplyDeleteFinancial funds services in UAE

Asset Management Companies in UAE

Dubai funds

Funds in Dubai

Funds in UAE

UAE Funds