Introduction

The phenomenal growth in UCITS III hedge funds over the last few years has been one of the most interesting developments in the global alternative investment sector. Currently, the Eurekahedge UCITS III Hedge Fund Database lists 775 UCITS III products, with another 500 to be added in the coming months. Furthermore, the Eurekahedge UCITS Hedge Fund Index, the industry benchmark and most widely used tracker in the sector, consolidates the monthly performance of 236 funds.

Utilising data from the Eurekahedge UCITS Hedge Fund Database, this report picks up from our introductory piece in March 2010 and analyses the key trends emerging from the UCITS III hedge fund sector over the last few years. For a more detailed introduction on the unique features of UCITS III regulations and fund structure, please refer to our previous report.

Figure 1 shows the growth in UCITS III hedge funds in the last three years.

Figure 1: Industry Growth over the Years

The size of the global UCITS III hedge fund industry currently stands at US$131 billion, managed by 615 unique (flagship) funds. Given the rapidly changing dynamics of the industry, we predict this number to continue growing at a rapid pace. An important point to note here is that most of the growth in the UCITS III fund industry comes not from new boutique fund start-ups but from the following three segments:

a) UCITS III funds launched by existing hedge fund management companies. In the post-financial crisis environment where issues of regulations, transparency and liquidity have taken centre stage, existing hedge fund managers have identified the UCITS structure as a key to raising assets. Additionally, the UCITS passport further helps in providing access to retail investors, a previously untapped source of capital for hedge funds.

b) Hedge fund products launched by existing mutual fund management companies. The widespread losses suffered by mutual funds in 2008 and early 2009 brought their performance in sharp contrast to that of hedge funds. As such, mutual fund companies are increasingly looking to capitalise on the flexibility in investment approach afforded by the UCITS III regulation where they can also employ downside protection measures.

c) The growth in UCITS III funds is further compounded by a significant number of existing 'regular' hedge fund managers who make wholesale shifts to the UCITS structure. Such funds tend to have an existing investment approach that is very close to the UCITS requirements (mostly by initial design) and as such, these funds are then treated as UCITS funds since inception.

Figures 2a-2b: Growth of UCITS Hedge Funds Relative to Global Hedge Funds

Geographical Investment Mandate

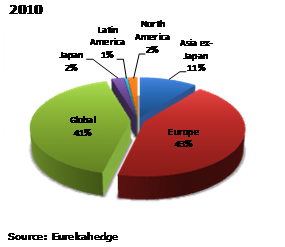

Figures 3a-3b: Changes in the Geographic Mix of UCITS III Funds

Since UCITS is a European regulation, it comes as no surprise that the largest share of investments on a regional basis goes to Europe. Also, UCITS III managers are located primarily in Europe and most managers tend to invest in the regions that they are based in.

However, there has been a trend of increasing diversity in the geographic focus of investments. While the share of Europe-focused funds has decreased from 47% to 43%, global-mandated funds have increased their share of the pie. Nevertheless, the small share of North America-dedicated funds is counter-intuitive as the region is home to the largest market with the most number of hedge fund investment products. This is primarily because European funds that invest in North America do so as part of the global mandate. In fact, nearly 90% of the global-focused funds include North America (or USA) in their investment mandates.

While the share of Asia ex-Japan funds has remained unchanged at 11%, it is important to note that this forms a substantial share of the asset allocations of European funds. The region has witnessed the greatest growth in recent times and since many European investors are keen to gain exposure to emerging markets, we expect their share to increase over time.

Domiciles

Figures 4a-4b: Domicile by Number of Funds

As per UCITS regulation, all UCITS funds are required to be domiciled onshore in a member state of the European Union. While traditional European hedge funds are primarily domiciled in offshore centres like the Cayman Islands, the largest onshore hedge fund domiciles are Luxembourg and Ireland, together accounting to 75% of the industry. These two locations are preferred over other EU nations because they possess the necessary infrastructure to service UCITS funds (ie, large number of service providers) as well as having more friendly tax regulations.

Between the two locations, though Luxembourg still accounts for 50% of the fund domiciles, Ireland has managed to increase its share by 6% over the last three years. Currently, the two centres hold distinct advantages over each other: while it is much more economical to set up in Ireland (Irish regulators require fund promoters to have a minimum capital of €0.64 million, whereas the requirement in Luxembourg is in the region of €7.5 million); the service provider industry in Luxembourg is better suited to administer high volumes of transactions on a daily basis which is a key benefit since a number of hedge fund managers are launching UCITS products to target the retail investor market segment.

Head Office Location

Figures 5a-5b: Head Office Location by Number of Funds

In terms of head office locations, Europe continues to account for nearly 90% of UCITS III hedge funds. This is primarily because a) UCITS is an EU regulation, hence, it is easier for European funds to subscribe and b) most UCITS III investors are European and it is easier to market the fund if the manager is based in Europe.

The United Kingdom dominates the manager location breakdown of UCITS hedge funds, accounting for nearly half of the fund population. While the population of UCITS funds was more widely distributed previously because of its pan-European base, the share of UK-based UCITS funds has increased by 12% in the last three years, primarily because of the strong launch activity witnessed in the last two years. For new managers who are considering launching a UCITS III fund, the location offers access to large pool of hedge fund and fund of funds investors. UK investors are also familiar with the UCITS framework and are a ready source of start-up capital for the newly regulated hedge funds. Additionally, London also boasts a wide range of service providers and administrators as well as top talent and infrastructure, making it a one-stop shop for managers looking to set up a fund.

Furthermore, being one of the most important financial service centres in the world, the country is already home to a large number of alternative investment management companies (43% of all European hedge funds are based in the UK) and as such, it is the natural location for UCITS III-compliant vehicles offered by existing companies.

Strategic Mandates

Figures 6a-6b: Changes in the Strategic Mix of UCITS III Funds by Number of Funds

In terms of strategic mandates, the structure of UCITS III hedge funds has witnessed some considerable changes. While there is now greater diversity in the sector in terms of asset classes and strategies employed, the major change has been the shift from long-only absolute return strategies towards long/short equity mandate. The primary reason for this is, again, the exceptionally strong launch activity in the sector over the last two years, especially by hedge fund management companies (that have been looking to raise assets from investors who have increasingly demanded regulated products). Furthermore, nearly 50% of the funds launched in 2009 and 2010 employ the long/short equity mandate for the following reasons:

a) Long/short equity forms the largest share of global hedge fund strategies (31%); hence, the proportion of existing hedge fund management company launching UCITS funds would naturally be in favour of this strategy.

b) It is relatively easier for long/short equity managers (and of course, long-only absolute return funds) to operate under the UCITS umbrella.

c) As opposed to complex strategies, long/short equity is more intuitive and easily marketed to retail investors who may not be as sophisticated as traditional hedge fund investors

Additionally, there are also a handful of long-only absolute return funds that have modified their strategy to take advantage of the shorting ability available under the UCITS framework, hence, effectively becoming long/short equity funds.

Performance Review

This section compares the performance of UCITS III hedge funds against other comparative investment vehicles and the relative performance of different strategic mandates within the UCITS hedge fund sector over the last five years.

Figure 7 shows how UCITS III hedge funds have performed versus hedge funds, funds of hedge funds and the MSCI World Index.

Figure 7: Performance of UCITS III Hedge Funds vs Other Investments

When compared with the underlying equity markets, UCITS III hedge funds have not only provided better downside protection but also have managed to capture most of the upside, hence, providing greater returns over the longer term with less volatility than investing directly in the markets (through traditional mutual funds, unit trusts, ETFs and suchlike).

Hedge funds, on the other hand, have outperformed UCITS III hedge funds – while the UCITS III funds have gained about 20% over the last five years, hedge funds have delivered nearly twice the returns. The reasons for this include high leverage employed by unregulated hedge funds to boost their profits and strong returns generated by event driven and distressed debt strategies, which have very little representation in the UCITS III space. However, with an increasing number of hedge fund managers launching their own UCITS funds, we expect the performance numbers to compare more favourably in the future and in the shorter term. In fact, as shown in Figure 7, the returns of UCITS III hedge funds have been closer to those of hedge funds over the last 12 months.

Figure 8: Performance of UCITS III Hedge Funds vs Other Investments

UCITS III hedge fund returns also show that these regulated products tend to fall at the midpoint of hedge fund and fund of funds performances. When compared with funds of hedge funds, there are two main factors which benefited UCITS III managers in the last two to three years. First, in 2008, they had greater flexibility to close on positions that they are holding and were able to quickly liquidate them as the markets started to tumble while funds of funds were left exposed to various illiquid hedge funds with gated redemptions. Secondly, in 2009, funds of funds witnessed redemptions through most of the year, hence, being forced to redeem their capital out of underlying hedge funds that were witnessing a record year in terms of performance. UCITS III managers, on the other hand, saw strong interest in their funds from investors.

Table 1 shows the statistics of the different investment vehicles considered in this analysis.

Table 1: 3-Year Performance of Alternative UCITS III Hedge Funds and Equities

(From July 2007 to July 2010)

|

Eurekahedge UCITS

Hedge Fund Index

|

MSCI World Index

|

Eurekahedge Fund of Funds Index

|

Eurekahedge Hedge Fund Index

|

12-Month Returns

|

7.17%

|

7.66%

|

3.00%

|

7.59%

|

3-Year Annualised Returns

|

-0.72%

|

-10.44%

|

-3.69%

|

3.99%

|

3-Year Annualised Standard Deviation

|

10.18%

|

23.00%

|

7.14%

|

7.35%

|

Figure 9 compares UCITS III fund performance with that of mutual funds over the last three years. Some of the reasons for the differences observed below are:

a) Unlike hedge funds, mutual funds have investment objectives which restrict their allocation of assets. This affects their performance to a large extent, which partly explains why they tend to underperform UCITS III hedge funds.

b) As a result of performance-enhancing techniques such as leveraging, UCITS III hedge funds have delivered better returns than mutual funds for three out of the four years shown in Figure 9, the exception being 2009 when the strong rallies in underlying markets delivered exceptional gains to mutual funds.

c) Furthermore, the ability of UCITS III hedge funds to employ synthetic shorts has greatly helped them to outperform mutual funds in time of economic downturns. For example, in 2008, UCITS III hedge funds delivered returns of -14.72% at a time when mutual funds were down 35% on average and the underlying markets lost up to 60%.

In the last three years, UCITS III hedge funds have outperformed mutual funds by more than 15%, which is a reflection of their main investment philosophy – UCITS III hedge funds are absolute return vehicles and are supposedly mandated to protect capital in all market conditions while mutual funds tend to track their respective benchmark indices.

Figure 9: UCITS III Hedge Funds vs Mutual Funds

Strategies

Table 2: Performance across Strategies

|

Long-Only

|

Arbitrage

|

CTA /

Managed Futures

|

Event Driven

|

Fixed Income

|

Long/ Short Equities

|

Macro

|

Multi-Strategy

|

12-Month

Returns

|

3.00%

|

1.31%

|

4.52%

|

3.25%

|

4.59%

|

4.09%

|

3.54%

|

2.71%

|

3-Year

Annualised

Returns

|

-3.69%

|

3.12%

|

2.43%

|

2.01%

|

3.19%

|

1.48%

|

4.78%

|

2.54%

|

3-Year

Annualised

Volatility

|

7.14%

|

1.72%

|

4.67%

|

2.39%

|

2.72%

|

7.38%

|

4.07%

|

6.53%

|

Figure 10: Performance across Strategies

UCITS III hedge funds have witnessed positive results across all strategies over the last 12 months. Fixed income UCITS III hedge funds advanced 4.6% as low interest rates nurtured a favourable environment for fixed income hedge funds. Within the sector, hedge fund managers who focused on high yielding debt saw the biggest gains. Over the three-year timeframe, fixed income hedge funds delivered annualised gains of 3.2%, outperforming the average UCITS III hedge funds by nearly 4% every year.

UCITS III CTA/managed futures hedge funds have been the best performing in 2010 while macro funds show the highest three-year annualised returns as they were able to capture the upside in trending markets in 2009 while also delivering positive returns in 2008.

Fees

Table 3: Fee Structure of Global Hedge Fund and UCITS III Hedge Fund Launches

|

Global Hedge Funds

|

UCITS III Hedge Funds

|

Year

|

Average Performance Fee (%)

|

Average Management Fee (%)

|

Average Performance Fee (%)

|

Average Management Fee (%)

|

2007

|

19.32

|

1.74

|

12.42

|

1.20

|

2008

|

18.84

|

1.65

|

14.51

|

1.33

|

2009

|

17.61

|

1.64

|

16.88

|

1.44

|

July 2010

|

18.46

|

1.54

|

17.73

|

1.35

|

Table 3 shows the changes in the fee structures of global hedge funds and UCITS III hedge funds over the last three years. While the average management fees of both sectors remain low and at par with most mutual funds, the performance fees have shown some significant movements. The performance fees of hedge funds launched after 2008 dropped below 19% as managers found it increasingly hard to raise capital from sceptical investors. On the other hand, UCITS III hedge funds have consistently raised their fees over the last few years, primarily because of two reasons. First, the funds have seen increasing interest from hedge fund investors who are used to paying performance fees and have been drawn to the sector because of the regulated structure of the funds; hence, the managers can raise their fees without much fear of losing the incremental inflows. Secondly, an increasing number of hedge fund management companies that have traditionally operated in the 2/20 structure have launched their UCITS III products while replicating the fee structure of their traditional hedge funds.

In Closing

The UCITS III hedge fund sector has witnessed phenomenal growth over the last few years. The call for more transparency and regulation for hedge funds has seen a large number of UCITS III hedge fund launches in recent years – the number of UCITS III hedge funds has grown by 200% since 2007 and assets under management have increased 170% over the same period. The outlook for the UCITS III hedge fund industry looks promising as we expect to see more capital inflows not only from traditional hedge fund investors but also from retail investors while the number of launches in the space continues at an exponential pace.

By the end of 2010, we expect the size of the industry to exceed US$150 billion, with the number of funds figure closing in on the 1,000-mark. With incremental interest in UCITS III hedge funds and the fast pace of developments, we will be providing regular updates on the sector in our reports going forward. Watch this space in the coming months for more analyses including:

a) UCITS vs European hedge funds

b) Service provider landscape of UCITS funds

c) First movers and trendsetters in the UCITS III hedge fund sector

d) New start-ups vs new UCITS products by existing managers

e) Investor analysis of UCITS funds