Introduction

The Latin American hedge fund industry has seen tremendous growth in the last decade both in terms of performance and assets under management. Since its inception in December 1999, the Eurekahedge Latin American Hedge Fund Index has gained 422.8% while the number of Latin American hedge funds has also increased four-fold over this period. The growth in assets under management picked up incrementally after 2003, registering a three-fold increase from 2004 to 2007. Furthermore, Latin American hedge funds have posted average annualised returns of 15.4% since 2000 – the highest among all regional mandates covered by Eurekahedge over this period.

After weathering the financial crisis admirably, losing only 4.79% in 2008, Latin American managers delivered a year of robust returns in 2009, gaining a massive 26.94% – the best annual return on record since the bumper year of 2003. Starting the new decade on a high note, managers outperformed underlying markets in January and February 2010 while they achieved positive returns for March. Year-to-date March, the Eurekahedge Latin America Hedge Fund Index advanced 1.25%[1] – almost at par with the MSCI EM Latin America Index which was up 1.31%.

An important factor to consider when analysing the Latin American hedge fund industry is the difference between onshore and offshore hedge funds. Onshore Latin American hedge funds are mostly set-up in Brazil, which is the largest economy in the region, and denominated in the Brazilian real. The reason for a large local hedge fund market is that there are strict controls regulating the flow of capital in and out of the country: investors have to set-up special accounts, pay additional taxes and all transactions have to go through the central bank. As such, investors look for real-denominated hedge funds, thereby creating a market for hedge fund managers.

Based on the data in the Eurekahedge Latin American hedge fund database, we estimate the number of Latin American hedge funds to be 450, managing nearly $56.1 billion in assets as of March 2010. Figure 1 gives a snapshot of the industry development over the past decade.

Figure 1: Industry Growth over the Years

Industry Make-Up and Growth Trends

The growth seen in the Latin American hedge fund industry over the years has been a result of strong performances and significant capital inflows. Assets under management have grown from US$2.7 billion in 2000 to more than US$56 billion in 2010 – an incredible 20-fold increase. The industry reached its zenith in June 2008 with assets of US$58.4 billion before registering a sharp downturn due to the global financial crisis.

Since then, however, the sector has rebounded impressively with assets increasing by more than 42% in the last 12 months, bringing them almost at par with historical highs. Most of this growth is attributable to positive asset flows while the region also saw some significant start-up activity with 25 hedge funds launched over this period.

Asset Flows

Table 1: Monthly Asset Flow in Latin American Hedge Funds

Month

|

Net Growth (Perf)

|

Net Flows

|

Assets at end

|

2007

|

6.1

|

12.0

|

56.4

|

Jan-08

|

-0.5

|

-0.3

|

55.6

|

Feb-08

|

1.4

|

-0.5

|

56.5

|

Mar-08

|

-1.0

|

0.5

|

56.0

|

Apr-08

|

0.7

|

-0.1

|

56.6

|

May-08

|

1.2

|

-0.6

|

57.1

|

Jun-08

|

0.2

|

1.1

|

58.4

|

Jul-08

|

-0.8

|

0.6

|

58.2

|

Aug-08

|

-0.8

|

-0.8

|

56.6

|

Sep-08

|

-1.9

|

-2.1

|

52.7

|

Oct-08

|

-1.5

|

-2.9

|

48.3

|

Nov-08

|

0.2

|

-3.2

|

45.3

|

Dec-08

|

0.3

|

-3.7

|

41.9

|

2008

|

-2.5

|

-11.9

|

41.9

|

Jan-09

|

0.5

|

-2.2

|

40.2

|

Feb-09

|

0.1

|

-0.9

|

39.4

|

Mar-09

|

0.2

|

-0.3

|

39.3

|

Apr-09

|

0.9

|

0.6

|

40.8

|

May-09

|

1.2

|

1.9

|

43.9

|

Jun-09

|

0.1

|

0.6

|

44.7

|

Jul-09

|

0.8

|

1.5

|

47.0

|

Aug-09

|

0.6

|

1.7

|

49.3

|

Sep-09

|

0.9

|

1.3

|

51.5

|

Oct-09

|

0.2

|

0.8

|

52.5

|

Nov-09

|

0.7

|

0.5

|

53.8

|

Dec-09

|

0.4

|

0.3

|

54.5

|

2009

|

6.6

|

5.9

|

12.5

|

Jan-10

|

0.1

|

0.1

|

54.6

|

Feb-10

|

0.1

|

0.9

|

55.6

|

Mar-10

|

0.1

|

0.5

|

56.1

|

Compared with the global hedge fund industry, the rate of growth in Latin American hedge fund assets has exceeded the global average by 20% in the last two years as illustrated in Figure 2. Furthermore, when compared with other regional hedge fund mandates, the Latin American industry was the only market with net positive asset flows for 2009.

Figure 2: Latin America versus Global Asset Flows

The notable growth of the Latin American hedge fund industry is also attributed not only to the growing interest from international investors but also to the increasing attention from indigenous investors as evidenced by strong inflows to onshore hedge funds. Central banks in South America have been decreasing interest rates over the years (for example, the Central Bank of Brazil cut interest rates to 8.65% from 13.75% in a span of two years) which led to lower returns on financial deposits and hence, greater interest among local investors in onshore hedge funds, which have traditionally delivered excellent profits. Additionally, the strict capital flow controls in Brazil also led local investors to seek out real-denominated hedge funds as investing out of the country is a complicated process and has a mandatory additional taxes on investors.

With the stabilisation of global market conditions, increasing investor interest in emerging markets and a strong performance record – the Latin American hedge fund industry is poised for greater growth in 2010 in terms of both assets and number of hedge fund launches.

Figure 3: Onshore and Offshore Industry Growth over the Years

The Latin American hedge fund industry can be categorised into offshore and onshore vehicles, both of which have seen continuous growth over the decade. We need to differentiate between onshore and offshore hedge funds because a majority of the onshore hedge funds are based in Brazil and denominated in the real, which has very high interest rates, thereby generating higher returns than offshore hedge funds, which are usually denominated in US dollar or other major currencies.

While offshore hedge funds make up a larger proportion of assets under management in Latin America, the growth rate of onshore hedge funds has been greater in recent times. Before the financial crisis, high-net-worth individuals in Latin America had a strong preference for offshore fund structures due to tax incentives; however, due to the increasing focus on greater regulations, onshore hedge funds have started to generate greater demand. Not only have onshore managers recovered all of their assets that were withdrawn in 2008, the current size of the industry is at its all-time peak of US$18.2 billion.

Onshore Hedge Fund Regulation

Even though Latin American hedge funds have suffered some setbacks in 2008, primarily from negative net asset flows, the positive performances from 2008 through 2009 have provided investors with renewed confidence that the Latin American hedge fund industry is built on a solid foundation. The Latin American onshore hedge fund market is largely dominated by Brazil, which not only hosts a number of service providers but also employs one of the most comprehensive regulatory framework in the world.

Hedge funds domiciled in Brazil are mandated to have daily redemption policies and are regulated by the Comissão de Valores Mobiliários (Securities and Exchange Commission of Brazil). Additionally, onshore hedge funds are required to disclose their holdings to regulators on a monthly basis while some hedge funds also provide weekly reports to independent risk managers. The regulators in Chile, Brazil and Mexico are also much stricter in terms of liquidity, risk exposure, mark-to-market and net asset value accounting than their counterparts in offshore market.

There has not been a single case of fraud in the region partly because regulations require independent (third-party) service providers and external risk assessment for domestic hedge funds. The confidence in the industry is demonstrated by the fact that in percentage terms, the net flows into onshore hedge fund vehicles have outpaced net flows into offshore hedge funds over the last eight months.

Figure 4: Net Flows into Onshore and Offshore Latin American Hedge Funds

Head Office Location

While 90% of the onshore hedge funds are based in Brazil, the offshore hedge fund industry has greater diversity in manager locations. Figure 5 shows the breakdown of manager locations of offshore hedge funds.

Figure 5: Offshore Head Office Locations by Assets under Management

The offshore hedge fund space is dominated by the UK and the US, collectively accounting for more than half of all offshore hedge funds due to a stronger economic and investor base. The location of offshore hedge funds is in accordance with the greater proportion of global and emerging markets investing hedge funds in Europe and the US; however, there is now a greater dispersion in this geographical make-up, with UK’s share down from 50% in 2006 as the regional hedge funds gain more popularity with investors globally. Most of the offshore hedge funds invest in Brazil and other Latin American economies (the breakdown of offshore Latin American hedge fund allocations is given in the succeeding sections).

Brazil continues to dominate the onshore alternative fund landscape, which is in accordance with its status as the largest economy in Latin America (Brazil accounts for more than 50% of the total market capitalisation in the region) and the recipient of a large portion of the region’s hedge fund investments. Geographical proximity to investment regions offers hedge fund managers several advantages as they are able to better monitor the markets while also giving them the ability to meet executives and retrieve on the ground information about their target companies. Furthermore, Brazil provides an increasing pool of talented managers who are attracted by excellent market returns and a number of wealthy clients – the country has a growing affluent middle-class population, providing fund managers a ready investor base of high-net-worth individuals. Moreover, Brazil also boasts a comprehensive service provider industry and an expanding universe of financial instruments (for example, the Brazilian Mercantile and Futures Exchange has recently agreed to build an industry-leading platform with the Chicago Mercantile Exchange for its clients to trade cash equities and derivatives).

Fund Sizes

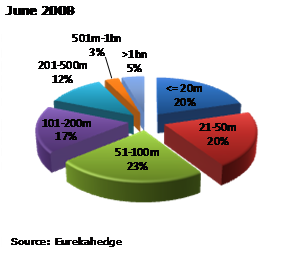

Figures 6a-6c: Latin American Hedge Fund Population by Size (US$ million)

The changes in the Latin American hedge fund industry’s composition, in terms of fund sizes, reflect its development over the years. The number of hedge funds managing more than US$1 billion grew to a maximum of 5% in June 2008 which corresponds to the highest level of assets under management of the sector. Although the subsequent turmoil in the financial markets worldwide caused substantial redemptions and losses due to forced selling, the number of larger hedge funds is once again on the rise. As compared with the statistics in September 2009[2], the proportion of hedge funds managing more than US$500 million is up from 5% to 7%.

The number of smaller hedge funds (less than US$20 million of assets under management) decreased over the years from 30% in 2006 to 20% in 2008. However, this number now stands at 31% as a significant portion of the existing hedge funds saw their assets decrease during the financial crisis while start-up activity rejuvenated in 2009.

Geographical Mandates

Figures 7a-7c show the changes in the geographical mandate of Latin American hedge funds over the last five years.

Figures 7a-7c: Latin American Hedge Fund Population by Geographic Mandate by Assets under Management

While the assets of hedge funds across all geographical mandates have increased over the years, the most evident trend is the comparative decrease in the assets under management share of global-mandated hedge funds and an increase in Latin America- and Brazil- investing hedge funds. Managers investing in Latin America and Brazil have performed strongly in the last two years, posting significant profits and attracting greater capital from investors. The recovery in Latin American markets has also outpaced the global turnaround – the MSCI EM Latin America Index gained 98.14% in 2009, shoring up investor confidence and interest in the region’s markets. Furthermore, there is an increasing population of high-net-worth individuals in Latin America who are familiar with the markets and have stepped up their hedge fund investments recently, preferring to allocate their capital to managers investing in the region rather than to globally mandated hedge funds.

Onshore Strategic Mandates

Figures 8a-8c: Onshore Hedge Fund Population by Strategic Mandate by Assets under Management

Most of Latin American onshore hedge funds employ a multi-strategy mandate investing in Brazil, taking the largest share of 54%. However, during the financial crisis in 2008, the spike in risk aversion led to a substantial amount of capital in multi-strategy hedge funds being reallocated to fixed income hedge funds, a move which proved beneficial for investors. Onshore Latin American fixed income hedge funds delivered returns of 11.53% in 2008, signifying an excellent performance in the face of market the global economic situation. Another significant development is the increase in the assets under management share of event driven hedge funds based in Latin America which have capitalised on the upside seen in the markets and through investing in new companies, specifically in the sectors of telecommunications and construction.

Long/short equity hedge funds, however, have lost a significant amount of their assets over the last two years, with their share also going down from 17% in June 2008 to 11% currently. While managers suffered significant performance-based losses in 2008, their market share is also down due to the increasing popularity of other strategies among the region’s investors.

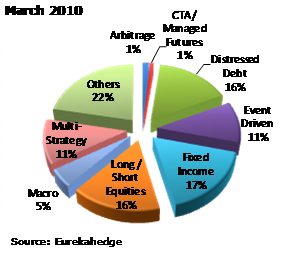

Offshore Strategic Mandates

Figures 9a-9c: Offshore Hedge Fund Population by Strategic Mandate by Assets under Management

In the last four years, event driven and distressed debt strategies have witnessed a significant increase in their share of offshore Latin American assets. Event driven and distressed debt hedge funds now account for 11% and 16% of the market, respectively, gaining assets primarily from extraordinary performances in 2009. In addition to returns of 59.82% in 2009, the region’s event driven hedge funds also witnessed substantial capital inflows, driven by the growing interest in emerging markets and availability of new corporate activity opportunities. Similarly, distressed debt managers posted a strong 55.9% return in 2009, hence increasing their assets substantially while also drawing capital from investors.

Fees

Table 2: Average Latin American Hedge Fund Fees by Launch Year

Year

|

Average Management Fees (%)

|

Average Performance Fees (%)

|

2004

|

1.70

|

19.67

|

2005

|

1.80

|

19.30

|

2006

|

1.73

|

19.27

|

2007

|

1.89

|

19.66

|

2008

|

1.90

|

20.47

|

2009

|

1.70

|

18.42

|

In a move to keep up client retention and growth, coupled with investors’ demand for lower fees and greater transparency, many hedge fund start-ups have taken additional steps to lower their management and performance fees in 2009. However, it is interesting to note that among all the strategies employed in the region, the CTA/managed futures space sought higher management and performance fees as managers need to meet margin requirements for their futures contract.

Performance Review

Despite adverse market conditions witnessed in the last 10 years, particularly the Argentinean debt crisis in 2000 and the global financial crisis in 2008, Latin American hedge funds have consistently posted positive performances throughout the decade. The Eurekahedge Latin American Hedge Fund Index delivered a 10-year annualised return of 15.4%, outperforming the MSCI Latin American Index. In the same period, Latin American hedge funds achieved an annualised volatility of 5.9%, which is substantially lower than that of South American stocks (28.6%). This performance shows that hedge funds have the ability to produce stable returns and capitalise on market volatility even in the face of severe downturns. However, it must be mentioned here that a major contributor to this positive performance is the high interest rate on the Brazilian real in which most of the onshore hedge funds are denominated.

Figure 10: Performance of Latin American Hedge Funds vs MSCI Latin America

Figure 11: Performance of Onshore and Offshore Latin American Hedge Funds

Both onshore and offshore hedge funds exhibited positive returns in 2009, with offshore managers edging over onshore hedge funds by 3.21% on a rolling 12-month window due to the outperformance of fixed income and long/short equity hedge funds domiciled outside Latin America. However, as illustrated in Figure 11, onshore hedge funds have generated greater returns than offshore vehicles in the longer term.

Among the swing factors for the difference between the returns of onshore and offshore hedge funds in the longer term is the high interest rate divergence between the Brazilian real (most onshore hedge funds are managed in Brazil and denominated in the real), the US dollar and other key European currencies. Moreover, steep yielding Brazilian fixed income securities and a strong performance of the Bovespa Index in the last few years contributed to the upward trend of onshore hedge funds, since most onshore hedge funds are required to have a substantial amount of capital in Brazil.

Figure 12: Performance of Onshore and Offshore Latin American Hedge Funds

Table 3: Performance of Onshore and Offshore Latin American Hedge Funds

Eurekahedge Latin American Offshore Hedge Fund Index

|

Eurekahedge Latin American Onshore Hedge Fund Index

|

Eurekahedge Latin American Hedge Fund Index

| |

12-Month Returns

|

28.64%

|

22.21%

|

23.84%

|

3-Year Annualised Returns

|

6.00%

|

12.72%

|

10.66%

|

Annualised Standard Deviation

|

9.34%

|

4.73%

|

5.95%

|

Sharpe Ratio (RFR = 4%)

|

0.21

|

1.84

|

1.12

|

Maximum Drawdown (4 Years)

|

-19.69%

|

-6.24%

|

-10.10%

|

Figure 13: Performance of Latin American Hedge Funds across Strategic Mandates

In terms of strategic mandates, all strategies posted significant returns both in the short (12 months) and long terms (three years). Event driven hedge funds yielded the best returns as corporate activity surged both in the local and offshore markets. The volume of announced M&A deals in Brazil through 2009 totalled $81 billion and this number is expected to grow by 30 to 40% this year.

Latin American onshore arbitrage hedge fund managers have shown a remarkable ability to deliver consistently, having no negative year since 1999 and more impressively, having only one negative month in all of the last 10 years. There may be only a few hedge fund specialists in this area, but managers have been able to exploit market disruptions by consistently giving their investors positive double-digit returns throughout the last 10 years. The Eurekahedge Latin American Arbitrage Hedge Fund Index has a Sharpe ratio of 7.36 with no maximum drawdown in the last decade.

Table 4: Performance of Latin American Hedge Funds across Strategic Mandates

Eurekahedge

Latin American Arbitrage Hedge Fund Index

|

Eurekahedge

Latin American Event Driven Hedge Fund Index

|

Eurekahedge

Latin American Fixed Income Hedge Fund Index

|

Eurekahedge

Latin American Long / Short Equities Hedge Fund Index

|

Eurekahedge

Latin American Macro

Hedge Fund Index

|

Eurekahedge

Latin American Multi-Strategy Hedge Fund Index

|

Eurekahedge

Latin American Others

Hedge Fund Index

| |

12-Month Returns

|

8.99%

|

49.72%

|

13.91%

|

33.07%

|

14.13%

|

22.75%

|

30.30%

|

3-Year Annualised Returns

|

11.52%

|

18.64%

|

9.84%

|

9.58%

|

9.50%

|

10.26%

|

14.55%

|

Annualised Standard Deviation

|

1.02%

|

51.68%

|

1.73%

|

8.67%

|

5.19%

|

5.60%

|

6.49%

|

Sharpe Ratio (RFR = 4%)

|

7.36

|

0.28

|

3.37

|

0.64

|

1.06

|

1.12

|

1.62

|

Maximum Drawdown (4 Years)

|

0.00%

|

-10.77%

|

-1.30%

|

-16.80%

|

-3.38%

|

-9.57%

|

-7.52%

|

% Below HWM

|

0.00%

|

-2.07%

|

0.00%

|

-0.01%

|

-0.67%

|

0.00%

|

0.00%

|

Conclusion

Latin American hedge funds have experienced a wave of success over the years. While the industry, which started in the 1990s catering to a few wealthy individuals, has seen many market downturns in the past, hedge funds have always made strides towards recovery almost immediately and have emerged stronger after every economic recession. This resilience of hedge funds in the Latin American region was seen from their significant performances in 2008 and 2009. While many expected a period of dispersion and decreased correlation among fund managers returns to ensue, Latin American managers were barely scathed by the credit crisis as hedge funds exhibited excellent performance the following year – the Eurekahedge Latin American Hedge Fund Index gained 26.9% in 2009, more than making up for the 4.7% loss in 2008.

With the global economic recession seemingly behind us, the Latin American hedge fund industry is poised to soar higher as the regional markets scales to greater economic heights. Underlying markets are predicted to post robust growth in the near future; Brazil, which most Latin American hedge funds invest in, is expected to grow more than 5% in 2010 which would signal the second-fastest pace in 22 years. Investments in onshore hedge funds remained buoyant during the market turmoil and should see more inflows this year. 2010 is set to be another great year for Latin American hedge funds as years of economic reform have begun to pay off, creating a plethora of opportunities for asset managers and investors alike.